What Is An S Corp

An S corporation is a tax classification that can protect small-business owners’ assets from double taxation. An S corp. utilizes pass-through taxation, meaning an owner claims a share of company profits on their individual tax return. This ensures profits aren’t double-taxed .

The S” in S corp. stands for subchapter,” because an S corp. is a subchapter corporation. When incorporating a business, you’ll first form a C corp. that must meet S corp. requirements to be so classified. The requirements include electing S corp. status two months and fifteen days after officially organizing your business , capping ownership at 100 individuals , and limiting those owner shares to U.S. citizens only. If you form an LLC, you’ll also need to file IRS Form 2553 to elect a tax classification.

S corp. owners can be company employees. Owner-employees must pay themselves a reasonable salary for their work. They’ll pay federal and state income tax, Medicare tax, and Social Security tax on that salary. Owners receive additional profits as distributions, which aren’t subject to Medicare and Social Security taxes.

Do You Need A Sole Proprietorship An S Corp Or An Llc

Modified date: Jun. 1, 2021

Editor’s note –

Creating your own small business is a huge endeavor, which comes with a number of decisions. One of the most important decisions youll need to make is how you structure your business.

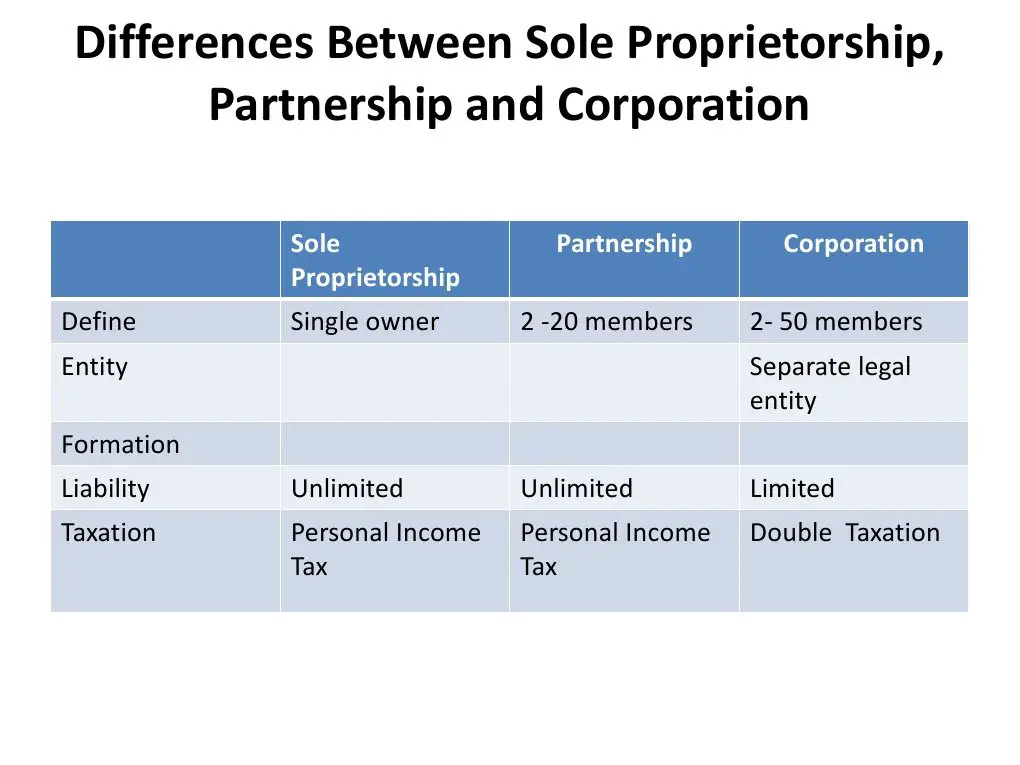

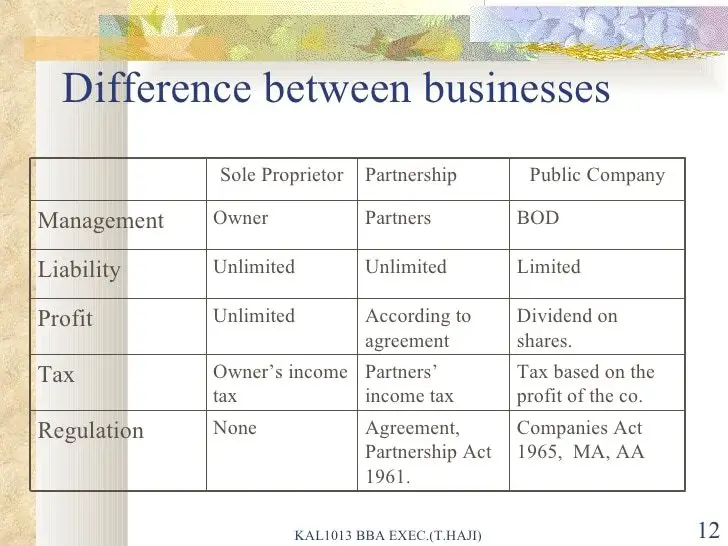

This choice will have major legal and tax implications down the road. Choosing between a sole proprietorship, LLC, and S Corp for your companys structure is not something you should take lightly. These are three common structures for small businesses and each one has its own advantages and disadvantages. Heres a rundown of all three to help you decide which is best for your business.

Pros And Cons Of Sole Proprietorships

If youve decided to take on this endeavor by yourself, a sole proprietorship is probably the way to go. The advantage? Complete control.

Unlike an LLC, there arent any complicated legal agreements involved that determine ownership. If youre a sole proprietor, you can run the business however you want.

| The Pros | |

|---|---|

|

Complete control and flexibility to run the business as you see fit |

Personally liable for all business debts, youre all by yourself |

|

Unlimited liability means creditors are more likely to extend credit if needed |

Banks are reluctant to give loans due to higher turnover rates and usually smaller assets |

|

You receive all business profits |

|

|

Smaller amounts of capital make for easier organization |

Since the business relies on one person only, it is harder to raise capital on a long-term basis |

You May Like: Should I Go Solar In Arizona

What Is The Difference Between An Llc And An S Corp

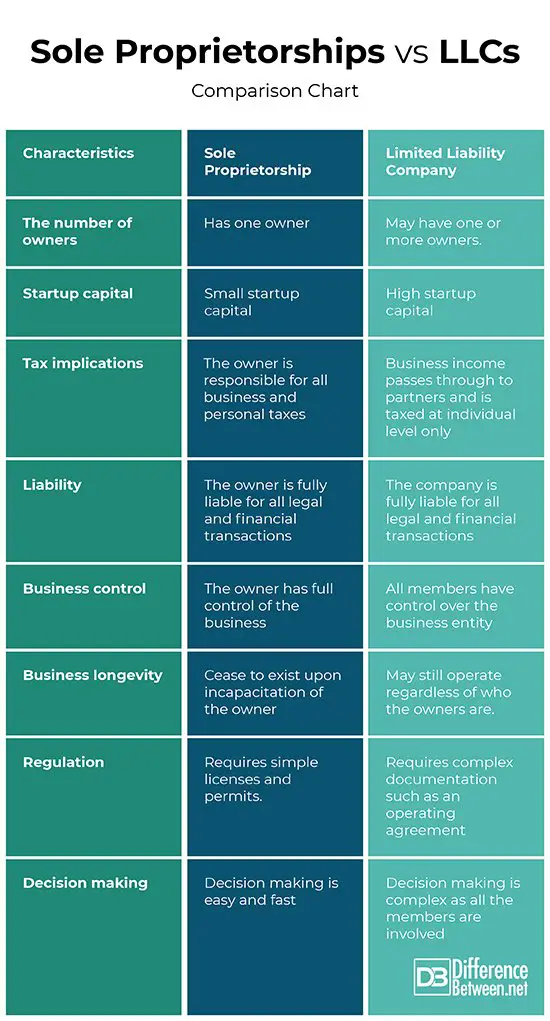

A limited liability company is easier to establish and has fewer regulatory requirements than other corporations. LLCs allow for personal liability protection, which means creditors cannot go after the owner’s personal assets. An LLC allows pass-through taxation, meaning business income or losses are recorded and taxed on the owner’s personal tax return. LLCs are beneficial for sole proprietorships and partnerships. An LLC with multiple owners would be taxed as a partnership, meaning each owner would report profit and losses on their personal tax return.

An S corporation’s structure also protects business owners’ personal assets from any corporate liability and passes through income, usually in the form of dividends, to avoid double corporate and personal taxation. S corporations help companies establish credibility as a corporation since they have more oversight. S corps must have a board of directors who oversee the management of the company. However, S corps can have100 shareholders and pay them dividends or cash payments from the company’s profits.

Why Would You Choose An S Corporation

An S corporation provides limited liability protection so that personal assets cannot be taken to satisfy business debts by creditors. S corporations also can help the owner save money on corporate taxes since it allows the owner to report the income that’s passed through the business to the owner to be taxed at the personal income tax rate. If there will be multiple people involved in running the company, an S corp would be better than an LLC since there would be oversight via the board of directors. Also, members can be employees, and an S corp allows the members to receive cash dividends from company profits, which can be a great employee perk.

You May Like: How Much Tax Credit For Solar Panels In California

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

What Are The Disadvantages Of Being A Sole Trader

Disadvantages of sole trading include that:

- you have unlimited liability for debts as theres no legal distinction between private and business assets.

- your capacity to raise capital is limited.

- all the responsibility for making day-to-day business decisions is yours.

- retaining high-calibre employees can be difficult.

Recommended Reading: How Much Does A Big Solar Panel Cost

Choosing A Sole Proprietorship Vs S Corporation

When you start a business, choosing a business entity is one of the first decisions you’ll make, and it’s also one of the most important decisions, too. Understanding the benefits and drawbacks of each one is necessary to making an informed decision. While we’ve already discussed the tax benefits and drawbacks of an LLC, our small business accounting firm wanted to provide a comparison of a sole proprietorship vs an S corporation to help you determine which one would have the greater benefit.

What Is A Sole Proprietorship

A sole proprietorship is an unincorporated business structure that isnt legally separated from its owner. Sole proprietorships dont offer limited liability protection or tax options.

Limited Liability Protection A type of legal protection that shields a business owner’s personal assets from losses and debts incurred by the business.

Sole Proprietorship Taxes

Sole proprietors pay income tax and self-employment tax on their businesss net profit. The businesss income passes-through to the owners individual tax return.

Pass-Through Taxation A system of taxation whereby the businesss profits or losses arent taxed at the business level. Instead, they pass-through to the owners personal tax returns and are taxed at each owners personal income tax rate.

When a sole proprietor has significant profit and minimal expenses, paying self-employment tax and income tax can create a heavy tax burden. An example would be an electrician or other skilled trades professional.

Also Check: Is Solar Worth It In Texas

Pros And Cons Of Limited Liability Corporations

With the limited liability characteristics of a corporation and the convenience of a flow-through income taxation , this option is suitable for multiple ownership circumstances.

| The Pros | The Cons |

|---|---|

|

You have the flexibility of being taxed as a sole proprietor, partnership, S corporation or C corporation. |

As an LLC member, you cannot pay yourself wages. |

|

Less paperwork and lower filing costs |

High renewal fees or publication requirements can be pricey, depending on your state. |

|

You can form an LLC with as little as one person, but you can also have an unlimited number of members. |

Many states have a franchise or capital values tax on LLCs, ranging from a flat fee to an amount based on the companys revenue |

|

Flow-through income taxation, keeping things simple |

Investors may be more likely to put their money into a corporation, making it harder to raise financial capital |

|

Members are protected from some liability if the company runs into legal issues or debts. |

Unless you are running the LLC alone, the ownership of the business is spread across its members |

|

Members can receive revenues that are larger than their individual ownership percentage. |

Can Sole Proprietors Become An S Corp

Often yes. Once youve established your LLC and found that the S Corporation taxes work in your favor, there are a few more requirements you should meet:

- You must be a U.S. citizen or resident

- LLC must be registered in the U.S.

- Have no more than 100 shareholders

- Have only one class of stock

- Owners cannot be partnerships or corporations.

There are a few more requirements you can find on the IRS website. The general theme is that these entities have much more restrictive ownership requirements. If ownership flexibility is important to you, needing lots of startup capital, for example, a partnership or C Corp could be better choices.

Also Check: Is My Business An Llc Or Sole Proprietorship

What Is The Difference Between Self Employed And Sole Proprietor

Answer itselfemployeddifferencesole proprietor

Likewise, what tax forms do I need to file as a sole proprietor?

Schedule CSchedule Creport

Can you file LLC taxes with personal taxes?

IRStaxLLCtaxesfilereturnIRSLLCyouLLCtax return

Do sole proprietors pay sales tax?

Sole proprietorspaysales taxessole proprietorpaytaxessalestaxes

Setting Up An S Corporation

- Establishing an S Corporation involves submitting Articles of Incorporation to the Secretary of State or relevant government official.

- An S Corporation distributes stock and is run as a corporation with directors, executives, and shareholders.

- An advantage of an S Corp is that a shareholder’s own assets, such as personal finances, are protected in the case of the business being sued.

If you need help with sole proprietorship or S Corporations, you can post your legal need on UpCounsel’s marketplace. UpCounsel accepts only the top 5 percent of lawyers to its site. Lawyers on UpCounsel come from law schools such as Harvard Law and Yale Law and average 14 years of legal experience, including work with or on behalf of companies like Google, Menlo Ventures, and Airbnb.

Hire the top business lawyers and save up to 60% on legal fees

Read Also: Is Solar A Good Career

Tl dr: Should You Convert From An Llc To An S Corp

In most cases, if your business has reached a point where youre ready to make it official, you likely earn enough that an S Corp election could help you save thousands of dollars each year in taxes.

Thanks to Collective, I dont have to worry about bookkeeping, taxes and other government related tasks and can focus a 100% on my work. If youre self-employed and need help with legal, tax, bookkeeping and ongoing support, all-in-one place, youll love Collective!

Arjun Dev Arora

Sole Proprietorship Vs S Corp: Whats The Difference

A sole proprietorship is an unincorporated business that doesnt have any legal separation from its owner.

An S corp is an LLC or corporation that has elected to be taxed as an S corporation.

Sole Proprietorship vs S Corp The main difference between a sole proprietorship and an S corp is that S corps have limited liability protection and tax options, whereas sole proprietorships do not.

You May Like: How To Make Your Rv Solar Powered

Why An S Corp Over An Llc

If you form an LLC without electing S Corp taxation, you could have a higher tax bill. The IRS taxes an LLC as a sole proprietorship by default, which includes self-employment tax on all of your businesss profits.

Electing S Corp status for your LLC could reduce the amount of income subject to self-employment tax. Ultimately reducing what you pay in taxes overall.

Taxes: S Corporation Versus Sole Proprietorship

A sole proprietorship is suitable for a person who wants to go into business without being subjected to the stringent state and federal requirements of other entity types. However, business owners who want to get limited liability protection or co-own need to file as S-corporations.

If you need help to choose between an S-corp and a sole proprietorship, you can post your legal need on UpCounsel’s marketplace. UpCounsel accepts only the top 5 percent of lawyers to its site. Lawyers on UpCounsel come from law schools such as Harvard Law and Yale Law and average 14 years of legal experience, including work with or on behalf of companies like Google, Menlo Ventures, and Airbnb.

Hire the top business lawyers and save up to 60% on legal fees

Recommended Reading: Can Solar Panels Work On A Cloudy Day

S Corporation Business Operations

There are significant legal differences in terms of formal operational requirements, with S corporations being much more rigidly structured. The numerous internal formalities required for S corporations include strict regulations on adopting corporate bylaws, conducting initial and annual shareholders meetings, keeping and retaining company meeting minutes, and extensive regulations related to issuing stock shares.

Further, an S Corporation may use either accrual or cash basis accounting practices.

Choosing A State To Incorporate

Since taxes, prices and corporate laws are not the same in every state, it is important to consider your home states advantages and disadvantages when it comes to forming your business.

Some things to consider when youre shopping for states:

- Is it worth incorporating outside your home state , even if that means paying extra tax fees?

- How are corporations taxed? What are the taxes if Im foreign-qualified?

- Would there be an income tax on my corporation?

- Is there a minimum or franchise tax?

- Compare projected revenue against cost of taxes for a given state to recognize any advantages

- Ultimately, the best thing that you can do for your business is research states corporate statutes and find what works best for you.

If youre on the fence, check out our blog post about the seven best states to incorporate.

Read Also: How Strong Are Solar Panels

Which Should You Choose

When you start a business by yourself, by opening a bank account, youve created a Sole Proprietorship. Thats right, you get this instantly because its the default for solo-founders.

A Sole Proprietorship is a default tax and legal treatment many Americans automatically get a big reason why its so common. Its estimated that 73% of all businesses in the U.S. are Sole Proprietorships. However many business owners keep it because it takes less paperwork and maintenance.

The Sole Proprietorship is the simplest business form because theyre not separate legal business entities, they refer to the person owning the business, holding you personally responsible. This simplicity is also its biggest flaw: unlimited liability. Simply put, youre personally liable for any legal damages created as a result of your business.

Thats right Sole Proprietorships dont offer you any legal protection. For that, youll need to register an LLC, or Limited Liability Company, to create a separate legal entity from you personally. This is why professional businesses are often LLCs, including S Corps.

S Corporations are simply a tax classification that LLCs can choose to adopt. This probably sounds like jargon, so well go through this step by step.

Legal entity: whats recognized by the law. A sole proprietor is simply seen as the person owning the business, while LLCs are separate legal entities in all U.S. states. Not only do LLCs have more legal protection, but they can choose their

Llc Vs Sole Proprietorship: Paperwork And Compliance

The final difference between an LLC vs. sole proprietorship has to do with paperwork and compliance requirements. As we mentioned earlier, a sole proprietorship requires the least amount of paperwork prior to launch. After launch, a sole proprietor only needs to keep up with federal, state, and local taxes. In addition, a sole proprietor might need to renew business permits.

An LLC has more compliance responsibilities. After filing initial articles of organization, LLCs have to file an annual report in many states. An LLC with multiple members has even more responsibilities, such as drafting an operating agreement, issuing membership units, recording transfers of ownership, and holding member meetings. None of these steps are legally required, but are highly recommended for LLCs to preserve liability protection for members. In addition, since an LLC is a registered business entity, dissolving an LLC takes additional paperwork.

You May Like: How Does Buying Solar Panels Work

What Are The Pros And Cons

In the Sole Proprietorship vs. S-Corporation debate, the answer to whether its more advantageous depends entirely on your unique needs. Setting up an S-Corporation requires that you put together paperwork and file documents with governmental agencies. S-Corporations may also have other ongoing filing requirements, like annual information statements. The requirements vary depending on the state where the S-Corporation is formed. By contrast, a Sole Proprietorship has none of these requirements. However, the pros may easily outweigh the time spent on extra paperwork. With protection from liability, the ability to raise capital, as well as the option for having up to 100 shareholders, forming an S-Corporation can be a very good business decision. Finally, it should be noted that S-Corporations may only be formed by U.S. citizens or resident aliens, whereas Sole Proprietorships, due to their nature, have no such limitations.

Ready to start your business? We make it easy to incorporate, whether you want to form an S-Corporation, LLC, Corporation, or Non-Profit.

This article contains general legal information and does not contain legal advice. Rocket Lawyer is not a law firm or a substitute for an attorney or law firm. The law is complex and changes often. For legal advice, please ask a lawyer.