It Can Protect You From Identity Theft

As an independent contractor, you are frequently enabling payment by sharing out information that connects you to the work you do for your multiple clients. While many contractors use their social security number for this, doing so makes key personal information vulnerable in the event that a client experiences a data breach.

Getting an EIN allows you to provide clients with a number thats linked to your business finances instead of your personal finances. In the event that your data gets stolen, thieves wont have access to your social security number.

Recommended Reading: What Do I Need For A Grid Tie Solar System

Solo 401k Rules For Sole Proprietor

Being a sole proprietor is the simplest and easiest way to start out in business. You typically do business under your personal name or you could have a DBA name. Most of the rules for a sole proprietorship are similar to any other business structure, except for a few main areas

When calculating contributions from your sole proprietorship you get to use net business income. Your salary deferral can be up to $19,500 or $26,000 if you are 50 years of age or older. This can be up to 100% of your net business income. Your employer profit sharing contribution is a little bit more complex to calculate. You can look at IRS publication 560 which has a deduction worksheet for self employed in chapter 6. This worksheet helps you calculate your employer profit sharing contribution. Its generally about 20% of your net business income minus half of your self employment income tax. You should work with a qualified tax professional to finalize your numbers. To get an estimate you can also use this Solo 401k calculator.

Your sole proprietorship contributions need to be made before your tax filing deadline. April 15 is the deadline for normal filing. If you file an extension you can make contributions all the way until October 15th. Put your tax deductible contributions on IRS Form 1040, Schedule 1, Line 15. You can write the check to make your contributions from your business checking account and deposit it into your Solo 401k Trust bank or brokerage account.

What Is A Solo 401

A solo 401 is a tax-advantaged retirement account thats designed for self-employed individuals and business owners who have zero employees, or no other employees than their spouses. This type of 401 plan is also known by a few other names:

Solo-k

Uni-k

One-participant plan

Solo 401 contributions are made using pre-tax dollars, though its possible to make Roth contributions instead. In that case, youd be able to withdraw money from a solo 401 tax-free in retirement.

A self-employed 401 plan works much the same as a regular 401, in that you may be able to take loans from your savings if needed. Catch-up contributions are also allowed. The biggest difference is that there is no matching contribution from an employer.

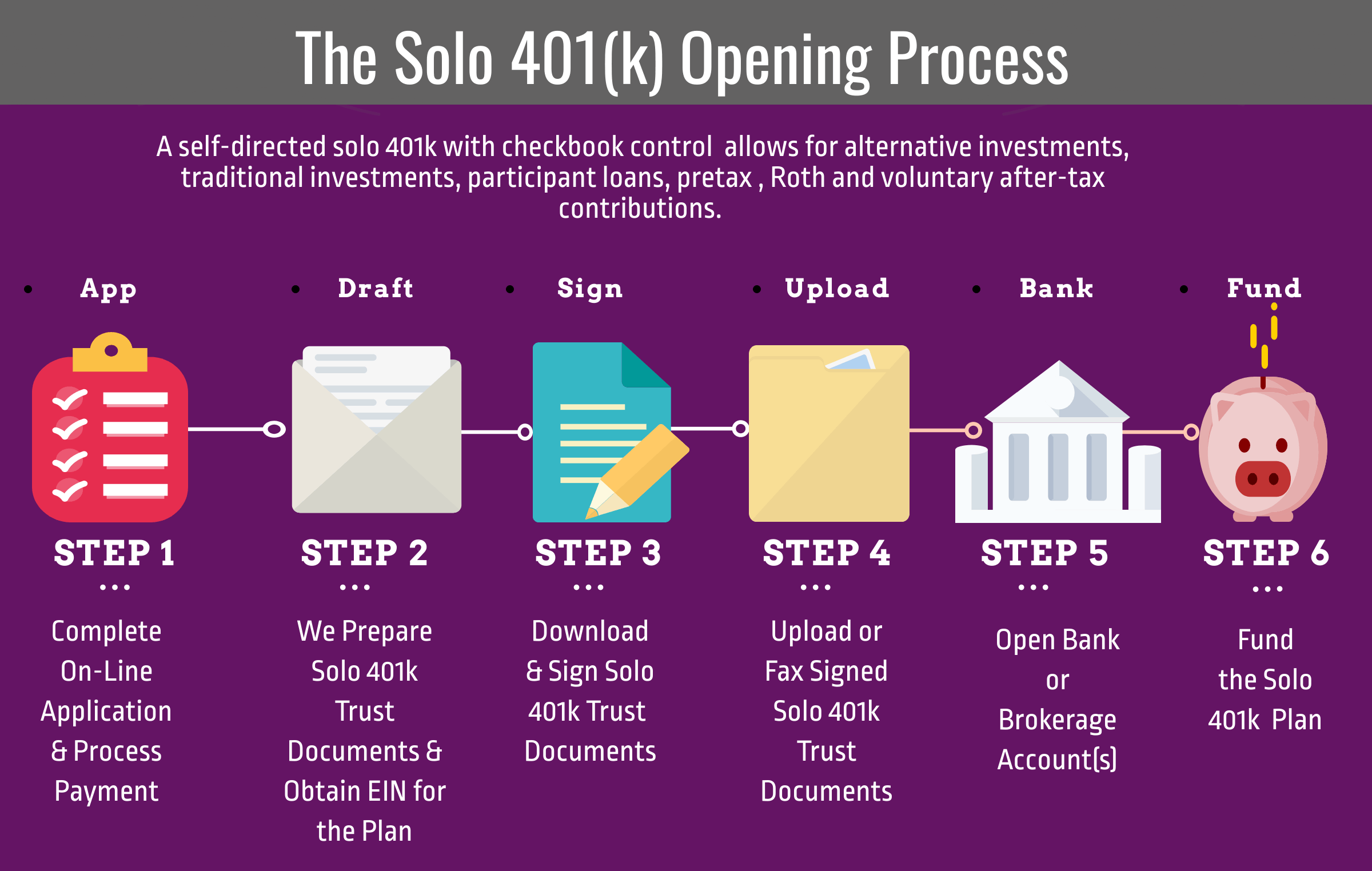

You can start investing in a solo 401 for yourself through an online brokerage. Theres some paperwork youll need to fill out to get the process started, but once your account is open you can make contributions year-round.

At the end of the year, the IRS requires solo 401 plan owners to file a Form 5500-EZ if the account has $250,000 or more in assets.

Don’t Miss: What Is A Solo 401k Vs Sep Ira

What Is A Solo 401 And How Does It Work

A solo 401 is a retirement plan for the self-employed.

If youre a business owner, a solo 401 is a way for you to access the same retirement benefits that youd get as a corporate employee.

In this article, Ill explain the myriad of solo 401 rules and compare solo 401s to SEP IRAs. Ill also share with you the solo 401 contribution limits for 2021.

Solo 401 Withdrawal Rules

When were young, 16 , 18 and 21 are milestone ages within the legal system.

But if youre older than 21, youve still got some special ages worth celebrating.

One of those is 59½. At that age, youre allowed to withdraw from any retirement account without paying a 10% early withdrawal penalty to the IRS. That includes a solo 401.

The only exception: If you have a Roth account of any kind, you must wait five years from the day you open it before you can make penalty-free withdrawals even after youre 59½.

If you dont take any money out of your solo 401 into your 70s, the government starts to wonder if it will get any tax revenue, especially from your traditional 401 funds.

Whether you contributed to a Roth 401, a traditional 401 or both, when youre 72 years old, youll need to start taking what are called Required Minimum Distributions . There are rules that determine exactly how much you need to withdraw each year after your 72nd birthday.

If youre still working at 72 years old, you can delay taking RMDs from your current 401.

Read Also: How To Get Certified In Solar Panel Installation

What Are The Factors That Differentiate The Solo 401 From An Employer 401

Three main factors distinguish a self-employed 401 plan from an employer 401 including:

-

You are the employer and employee on the plan as the business owner.

-

Solo 401 plans allow you to make far higher contributions to your retirement plan than if you are an employee in an employer 401.

-

Any self-employed person can open a solo 401 plan regardless of the product or service you provide.

You can also run a self-employed 401 account as a self-directed plan. It allows you to invest your contributions on specific assets with an investment broker trustee.

A solo 401 plan is ideal if you want to set up a retirement plan as a self-employed person. It has the highest contribution restrictions, which allows you to grow your retirement savings faster and you can also enjoy solo 401 tax benefits. It is also easy to set up and administer.

Self-employed 401 plans give you complete control of your investment choices if you open them in a self-directed brokerage account. If your business hires employees at a later date, you only need to convert the solo 401 account into a standard employer 401 plan.

Article By

The Human Interest Team

We believe that everyone deserves access to a secure financial future, which is why we make it easy to provide a 401 to your employees. Human Interest offers a low-cost 401 with automated administration, built-in investment advising, and integration with leading payroll providers.

Solo 401 Plan Eligibility Requirements

To be eligible for a solo 401 plan, your business cant employ non-owners that meet the plans age and service eligibility requirements. Meeting this solo requirement is very important because improperly excluding eligible non-owners from a 401 plan can trigger severe consequences including expensive corrective contributions or even plan disqualification.

To stay out of trouble, you must understand your solo 401 plans eligibility requirements to both owners and non-owners. Like all 401 plans, a solo plan must define its eligibility requirements in a written plan document. If a non-owner ever meets these requirements, you must let them enter your 401 plan on the entry date specified in your plan document. This will take your 401 plan out of solo status, but you have no choice to avoid the consequences for improperly excluding a non-owner. Youll also want to notify your 401 provider before a non-owner becomes plan-eligible to ensure they make any changes necessary to properly administer your plan as a non-solo.

Be sure to consider the controlled group rules applicable to 401 plans when applying your solo plans eligibility requirements. Under these rules, two or more employers with common ownership are considered a single employer for 401 plan purposes. That means you cant exclude controlled group employees meet your solo plans eligibility requirements.

Recommended Reading: How Does A Grid Tied Solar System Work

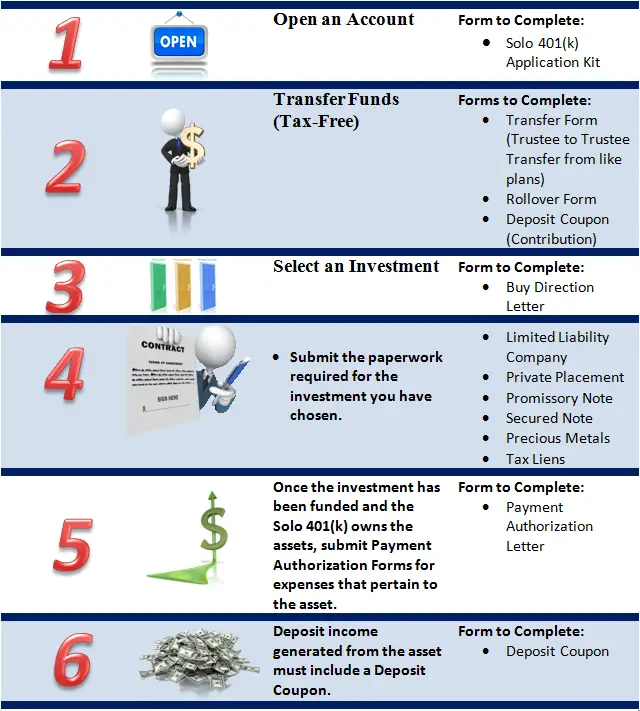

Fill Out A Solo 401 Application

Before you can start a 401 account for yourself, youll need to give your brokerage some information about your business. A typical solo 401 application may ask for your:

First and last name

Plan administrators name and contact information

Social Security number

Citizenship status

Income information

Youll also need to disclose any professional associations or affiliations that might result in a conflict of interest with the brokerage. In completing the application, youll be asked to name one or more beneficiaries. You may also be asked to provide bank account information that will be used to make your initial contribution to the plan.

What Is A 401k Plan Administrator

An administrator is the individual or entity who handles the administration of an employer-sponsored plan like the 401k. The 401k administrator is often hired by the 401k plan sponsor to handle the day to day activities and reporting of the 401k plan.

With a Solo 401k plan, your business it the plan sponsor. Therefore, your business can choose who will be the Solo 401k plan administrator. To keep record-keeping clean and easy, and to cut the fat of extra costs, most Solo 401k accountholders will act as their own Solo 401k plan administrator.

A 401k plan administrator will often handle the plan contributions, distributions, and other aspects of plan paperwork. This leaves the trustee to handle the investments. With the Solo 401k plan, it is common for the same person to act as 401k administrator and 401k trustee.

Also Check: What Is A Solar Charger

When Does It Make Sense To Open A Solo 401

A Solo 401 isnt the right investment strategy for everyone. Here are some scenarios when opening a Solo 401 makes sense:

- Youre a business owner and the only employee of your company: This might seem like a given, since this is the exact person Solo 401s are for, but its worth mentioning that its also the only person Solo 401s are for if youre not self-employed or if you have additional employees it wont work to open a 401.

- Youre self employed and want a retirement plan your spouse can contribute to: Since you can add contributions from your spouse to a Solo 401, opening one could be a strong strategy if your spouse currently doesnt have a retirement plan or if they havent maxed out other retirement contributions.

- You want the ability to take loans from the plan: While taking a loan from your own retirement plan isnt ideal, the realities of being a small business owner could mean you want or need that flexibility.

Also Check: Can You Sell Solar Energy Back To The Power Company

Can I Take A Loan From My Solo 401

Yes, you can take a loan from your solo 401, up to 50% of the account value and no greater than $50,000.

So if you have a $60,000 balance in your solo 401, the maximum you could borrow is $30,000.

If you have a $100,000 balance in your solo 401, the maximum you could borrow is $50,000.

And because the loan can be no greater than $50,000, even if you have a $1,000,000 balance in your solo 401, the maximum you could borrow is $50,000.

This loan must be paid back within five years, with interest.

You May Like: How To Get Tax Id For Sole Proprietorship

Pros & Cons Of Solo 401

Since you are saving for yourself, there are no transfer fees to worry about, no penalties for premature withdrawals, no restrictions on the investments that you can make, more money to invest because of the tax deductions you receive. Distributions you take from the Solo 401k plan are never subject to the 10% penalty. This is the case even if the solo 401k owner and beneficiary are under age 59 ½. But of course, there are exceptions if you take it on a regular basis. There are some rules in place not to do so, or there will be penalties and as I mentioned above, consult with your tax person.

What Are The Two Options?

Round #5how Easy Is It To Set It Up & Maintain A Solo 401 Or Sep Ira

Theyre both actually easy to set up. When you open a solo 401, the provider will usually create a solo 401 plan document for you. There are several solo 401 providers you can choose from. If youre a fan of Vanguard, you can create a Vanguard solo 401. You can also create a Fidelity 401 or ETrade solo 401. One downside with a Vanguard solo 401 is it does not allow you to roll over an existing IRA into your Vanguard solo 401. For about 2 years, I kept calling Vanguard to ask if they will allow this feature soon. We got tired of waiting and ended up opening another solo 401 with Etrade. One downside with a Fidelity solo 401 is it does not have a Roth 401 option.

If youre setting up a SEP IRA, its pretty straightforward to do so via Vanguard or Fidelity or ETrade. A lot of people forget this next step though. You will need to complete a Form 5305-SEP. Its just half a page long. No need to file with the IRS. This form officially creates your SEP IRA plan.

How easy is it to maintain: Solo 401 vs SEP IRA? Both are easy. However, with a solo 401, once the plans assets reach $250,000, youll need to file a Form 5500 each year to remain in compliance with IRS rules. Round 5 Winner: SEP wins, since theres a bit more paperwork with a 401.

You May Like: How Do You Put A Solar Cover On A Pool

What Are The Potential Tax Benefits Of A Solo 401k

Unlike the SEP IRA, you can pick your tax advantage with a solo 401k, either traditional or Roth contributions.

Traditional contributions are tax-deferred. Theyre tax-deductible, so they reduce your income in the year they are made. Then, distributions are taxed in retirement as ordinary income. Generally, traditional contributions are best if you think your income will go down in retirement.

Roth contributions are made with after-tax dollars. You pay taxes on your contributions when you make them, so theres no initial tax break. But then when you take distributions in retirement, they are tax-free. Roth is a better option if you expect your income to increase in retirement.

Related: How to Handle Taxes for Your Side Hustle

Do Roth Contributions Count Towards 401k Limit

The contribution limit is inclusive of any contributions that you make to your Roth Solo 401k. Remember that only employee salary deferral contributions can be put directly into the Roth 401k. This is limited to $19,500 with an additional catch-up contribution of $6,500 if you are age 50 or older. These Roth contributions can be up to 100% of your net self-employment income or W2 wages, depending on your business structure. Its important to note that if you have already contributed the $19,500 as a pre-tax traditional contribution, then you cannot do direct Roth 401k contributions.

It is also possible to split up this salary deferral in order for some money to go to pre-tax/traditional and some to the Roth 401k. Remember that Roth contributions are not tax deductible on the way in, but if the distributions are qualified when you take them out there is no tax due on all of the gains in your Roth accounts. The Solo 401k allows massive flexibility to vary your contributions year to year between your pre-tax/traditional bucket and your after-tax Roth bucket. This way you can decide how best to save for retirement in any given year based on your income, needed tax deductions and outlook for the future.

Also Check: How To Save Solar Energy

Solo 401k Rules For Multi

A multi owner LLC or partnership is a very common business structure. If you have one, you may be wondering, can I still have a Solo 401k even though my business has multiple owners who are not me or my spouse? The answer is yes! As usual, you just need to stay within the rules. With a multi-member LLC we can simply exclude the other partners from your Solo 401k plan by role title. We just need the other partners role titles, such as president or secretary. These should be listed in your LLC operating agreement

When we exclude the other role titles from your plan, this keeps your Solo 401k truly solo and separate from your other partners. Just the same, each partner can have their very own Solo 401k plan with the other partners excluded. Each plan can include the partners spouse whos plan it is.

Advantages Of A Solo 401

Here are some of the top benefits of a solo 401 plan:

- Access to a 401 retirement plan if youre self-employed. You dont have to be a W-2 employee at a large company to get access to a 401. If youre self-employed, a solo 401 gives you another option.

- Can make employee and employer contributions. A SEP IRA, which is the biggest alternative to a solo 401 for the self-employed, allows only employer contributions.

- Much higher contribution limits than an IRA. If you contribute to an Individual Retirement Account, youre allowed to put in a maximum of $6,000 per year . With a solo 401, you can set aside up to $58,000 per year in a tax-advantaged retirement account.

- Potential for a range of attractive features. Depending on the specifics of your solo 401 plan, you may be able to contribute to a Roth solo 401, access a huge range of investment options and take out a loan from your 401. Clark strongly advises against taking out a loan against your 401.

Read Also: How Many 100 Watt Solar Panels Do I Need

Solo 401k: The Retirement Plan Built For The Self

Were here to help! First and foremost, SoFi Learn strives to be a beneficial resource to you as you navigate your financial journey.Read moreWe develop content that covers a variety of financial topics. Sometimes, that content may include information about products, features, or services that SoFi does not provide.We aim to break down complicated concepts, loop you in on the latest trends, and keep you up-to-date on the stuff you can use to help get your money right.Read less

Being self-employed offers many perks, including freedom and flexibility. What it doesnt offer is an employer-sponsored retirement plan. But when you dont have access to a 401 at work, opening a solo 401 can make it easier to stay on track with retirement planning.

A solo 401 or one-participant 401 is a type of 401 thats designed specifically with self-employed individuals in mind. This retirement savings option follows many of the same rules as workplace 401 plans, in terms of annual contribution limits, tax treatment and withdrawals. But its tailored to individuals who run a business solo or only employ their spouses.

Its one of several self-employed retirement options you might consider when planning a long-term financial strategy. Before you establish a solo 401 for yourself, its important to understand how they work and the pros and cons that are involved.