What Costs Qualify For The Federal Solar Tax Credit

Most, if not all, of the costs associated with installing solar panels are eligible to be covered by the federal solar tax credit. Qualified costs include:

- Equipment: The cost of the solar panels, racking, wiring, and inverters.

- Contractor labor: The cost of labor associated with site preparation, installation, and planning, as well as the cost of any permitting fees and inspections.

- Sales tax: Any sales tax associated with the above costs is also covered by the tax credit.

Technically, the tax credit isn’t just for solar installations. Other clean energy systems can also get the tax credit, including solar water heaters, fuel cell systems, geothermal heat pumps, and even small wind energy systems!

Q Is A Roof Eligible For The Residential Energy Efficient Property Tax Credit

A. In general, traditional roofing materials and structural components do not qualify for the credit. However, some solar roofing tiles and solar roofing shingles serve as solar electric collectors while also performing the function of traditional roofing, serving both the functions of solar electric generation and structural support and such items may qualify for the credit. Components such as a roof’s decking or rafters that serve only a roofing or structural function do not qualify for the credit.

How Big Of A Difference Is A 26% Tax Credit Versus A 30% Tax Credit

Since the federal solar tax credit is applied to your solar arrays gross system cost, the amount you receive is dependent on the amount of solar youre purchasing: bigger system, bigger credit.

Heres a quick example of the difference in credits in 2021 and 2022 for a 9 kW solar array at an average cost of $27,000.

- Installed and claimed in 2021 taxes at the 26% level, your credit would be $7,020.

- Installed and claimed in 2022 taxes at the full 30% level, your credit would be $8,100.

Thats a savings difference of $1,080, equal to a years worth of $90 utility bills.

Don’t Miss: Where To Travel Solo In The Us

Who Can Qualify For Solar Incentives

Whether you can qualify for a solar incentive program depends on a few factors, including:

- Incentive availability in your state

- Whether you have tax liability

- Your annual income

Yes, its true: some states dont offer incentives for solar. In these places,solar can still make financial sense, but not because of anything the statelegislature is doing to help homeowners go solar.

The good news is everyone can qualify for the federal tax credit – as long as they have enough income to owe taxes.Tax liability is a fancy way of saying the amount that you pay in taxes.

Your annual income determines how much you owe, and if you make enough, youll be able to claim bothfederal and state solar tax credits. In many cases, you can claim thesecredits over multiple years if your tax liability is less than the totalamount of the credits.

Low-income solar incentives

Your annual income can also help you qualify for incentives in theopposite direction. If you make below the area median income inseveral states, you may qualify for low-income grants and rebatesthat can greatly reduce the cost to go solar – even making solarbasically free in some places.

Learn more:Low-income solar incentives by state

Do solar leases and PPAs qualify you for incentives?

The good news is that people who choose a solar lease or PPA in a statethat offers incentives will likely find the per-kWh electricity pricefrom the solar installer lower than people in states without incentives.

What Expenses Are Included

The following expenses are included:

- Solar PV panels or PV cells used to power an attic fan

- Contractor labor costs for onsite preparation, assembly, or original installation, including permitting fees, inspection costs, and developer fees

- Balance-of-system equipment, including wiring, inverters, and mounting equipment

- Energy storage devices that have a capacity rating of 3 kilowatt-hours or greater, or storage devices that are less than 3 kWh and are charged exclusively by associated solar PV panels. If the storage is installed in a subsequent tax year to when the solar energy system is installed it is still eligible, however, the energy storage devices are still subject to theinstallation date requirements). Note: A private letter ruling may not be relied on as precedent by other taxpayers.

- Sales taxes on eligible expenses

Read Also: Solar System For Off Grid Cabin

Does The Residential Solar Tax Credit Apply To New Home Purchases

If you buy a new home that already has solar installed, you can still claim the Residential Clean Energy Credit in the year that you move in, regardless of when the house was originally built or sold. For example, if your home was built in 2020, and then you bought it in 2021, but didnt move in until 2022, then you would claim the Residential Clean Energy Credit on your 2022 taxes.

Keep in mind, the Residential Clean Energy Credit can only be claimed once, so youll want to check and make sure that your builder hasnt already claimed the credit. If your builder has claimed it, then you may be able to ask for a reasonable allocation for those costs, and factor that into the final purchase price.

The Solar Energy Credit: Where To Draw The Line

How much of the cost of a roof replacement can be included in calculating the credit?

To encourage investment in solar energy , the Internal Revenue Code offers a credit to taxpayers who install solar energy equipment. Specifically, the taxpayer may take a 30% credit for the costs of the solar panels and related equipment and material installed to generate electricity for use by a residential or commercial building.

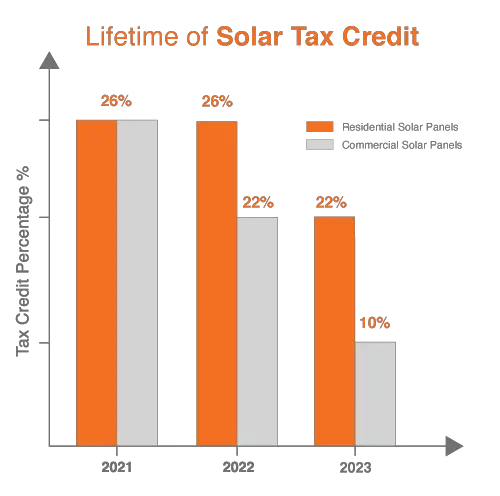

Sec. 25D provides a credit of 30% if the property was placed in service in a residence before Jan. 1, 2020, a 26% credit if the property was placed in service after Dec. 31, 2019, and before Jan. 1, 2021, and a 22% credit if the property was placed in service after Dec. 31, 2020, and before Jan. 1, 2022. Sec. 48 provides a 30% credit for solar energy equipment in commercial property if construction begins before Jan. 1, 2022.

This credit raises the question as to how much of the equipment and materials are properly includible for purposes of calculating the credit. Can a taxpayer include the entire cost of a new roof being installed in conjunction with the solar panels? Does it matter whether the roof is undamaged or in need of repair?

Sec. 25D Residential energy credit

Lastly, Notice 2013-70 provides two useful questions and answers:

A-21: The taxpayer may request that the homebuilder make a reasonable allocation or the taxpayer may use any other reasonable method to determine the cost of the property that is eligible for §25D.

. . .

You May Like: Solar Powered Flood Lights Lowes

Articles Reports & Videos From Nar

Vermonts highest court rules that property owners could not claim that commercial solar panel array constituted a nuisance because the solar array did not interfere with the owners use of their property, even though the owners claimed that the aesthetics of the solar panels had damaged their property values.

In this video, NAR and the Solar Energy Industries Association team up to talk about the opportunities for real estate practitioners in helping households buy and sell homes with solar energy systems.

What Projects Are Eligible For The Itc Or Ptc

To be eligible for the business ITC or PTC, the solar system must be:

- Located in the United States or U.S. territories

- Use new and limited previously used equipment

- Not leased to a tax-exempt entity , though tax exempt entities are eligible to receive the ITC themselves in the form of a direct payment.

Read Also: 40 X 20 Solar Pool Cover

How The New Solar Tax Credit In The Inflation Reduction Act Works

The Residential Clean Energy Credit allows you to subtract 30 percent of solar costs off your federal taxes, through 2032

Amid rising electricity and home energy costs across the country, the Inflation Reduction Act makes installing solar panels and storage batteries a more attractive investment for many homeowners than it was even a couple years ago.

With the new legislations Residential Clean Energy Credit, you can subtract 30 percent of the cost of installing solar heating, electricity generation, and other solar home products from your federal taxes. The credit is a reboot of an older, less valuable federal tax credit and will be available to taxpayers for more than a decade. That means homeowners considering solar installations have plenty of time to consider their options.

Here are key details.

What Are The Criteria To Claim The Solar Energy Credit

You can claim the credit once toward the original installation of the equipment. You must own the solar photovoltaic system and it must be located at your primary or secondary residence. If you are leasing solar panels, you don’t get the tax incentives.

There is no maximum amount that can be claimed, though. In addition, if you financed the system through the manufacturer and are contractually obligated to pay for it in full, you can claim the credit based on the full cost of the system.

You don’t even have to be connected to the electric grid to claim the federal solar tax credit, though there are definite financial incentives to being connected.

If Congress doesn’t renew it, the Federal Solar Investment Tax Credit will vanish in 2024.

Read Also: How Much Is Sunrun Solar

How Do I Claim The Tax Credit

To claim the tax credit, you must file IRS Form 5695 as part of your tax return. You’ll calculate the credit on the form, and then enter the result on your individual tax Form 1040.

If in last years taxes, you ended up with a bigger credit than you had income tax due, you cant get money back from the IRS. Instead, you can generally carry the credit over to the next tax year. Its important to understand that this is a tax credit and not a rebate or deduction. Tax credits offset the balance of tax due to the government .If you failed to claim the credit in a previous year, not to worry! You can file an amended return.

Federal Tax Credit For Residential Solar Energy

OVERVIEW

The federal solar tax credit for solar energy upgrades to your home may not be around for much longer. Here’s how to claim this credit.

In an effort to encourage Americans to use solar power, the U.S. government offers tax credits for solar-powered systems. Let’s take a closer look at some of the benefits of the solar tax credit and how you can claim it.

Don’t Miss: When Do Babies Eat Solid Food

What If I Owe Less Than My Tax Credit Value

The solar tax credit is non-refundable, meaning if your solar tax credit is worth more than what you owe in taxes, youre not going to get any sort of check or refund for it. But, that doesnt mean you wont get the full value of it. Any leftover value will carry over and be applied to your taxes the next year.

So, lets say you install solar panels and get a $6,000 tax credit, but you only owe $4,000 in federal income taxes. That leaves you with $2,000 of your tax credit that will be applied to next year’s taxes. The tax credit can be carried forward for a maximum of 5 years.

Now Is The Time To Install Solar To Take Advantage Of The Solar Tax Credit

Any tax advisor will tell you that the government creates tax credits to motivate taxpayers to behave in a certain way, whether its giving to charity, purchasing a home, or installing solar panels on the roof of their residence. Often these actions benefit the greater community as a whole, so the government has its own motivation to provide incentives.

Renewable energy or clean energy is once such area, and the government provides an incentive for homeowners to bite the bullet in terms of paying to install solar energy , which otherwise might be cost prohibitive, by providing these homeowners with a tax credit.

Is installing solar panels worth it for the tax credit? According to some estimates, the average cost of installing solar panels on a personal residence was around $16,860, which would currently result in a tax credit of $4,618. Of course, that means you still have to pay thousands of dollars to have solar energy equipment installed, so a better question might be to consider whether or not the energy savings are worth it over time. According to some estimates, your solar panels will pay for themselves in three years. The answer really depends on your location, how much energy you use, and your energy bill. No matter the answer to any of those questions, the tax savings that solar panel installation can provide you with dont seem to have a cloud in sight.

Bonus Video

Read Also: Veranda 5Ã5 Solar Post Cap

You May Like: How Much Can Solar Panels Produce

Solar Tax Credit Irs Form 5695

Step One Make sure you have receipts for all expenses. Keep these together and store them safely, so you have them if you get audited.

Step Two Confirm that youre able to claim the tax credit in the first place. Again, its easier than it sounds. If you own the system and expect to pay Federal taxes this year, youve already qualified for the residential energy solar tax credit.

Step Three in order to add up your credits and determine how much youre eligible to claim from Uncle Sam.

Step Four Include your information for the renewable energy credit onForm 1040.

Its easy to claim the federal solar energy tax credit with online tax filing. Their software will guide you through the process and provide all the correct forms. Be sure to keep the receipts for everything. Youll be expected to prove your expenditure if you get audited.

Some of the bigger expenses youre able to take advantage of include: the cost of the solar equipment, shipping costs, consulting fees, installation costs, the purchases of any tools, renting heavy equipment, and all associated permitting costs.

Costs will always vary depending on your personal circumstances and the solar system you want to install. The only thing you need to keep in mind is that you cant claim your labor as an expense.

Solar Tax Credit Eligibility Checklist For 2022

If youre not sure the ITC applies to you and your home, here is a checklist of criteria to keep in mind:

- Your solar photovoltaic system was installed between January 1, 2006 and December 31, 2034.

- Your solar PV system was installed on your primary or secondary residence in the United States.

- For an off-site community solar project, the electricity generated is credited against, and does not exceed, your homes electricity consumption. The IRS allows a taxpayer to claim a section 25D tax credit for purchasing a portion of a community solar project.

- You own the solar PV system, meaning you purchased it outright or financed it with a loan. You did not sign a lease or PPA.

- Your solar PV system is new or being used for the first timethe credit can only be claimed on the original installation of the solar equipment. For instance, if you bought a house that came with a solar system already installed, you would not be eligible for the credit.

Also Check: Does My Solar Power Work If The Power Goes Out

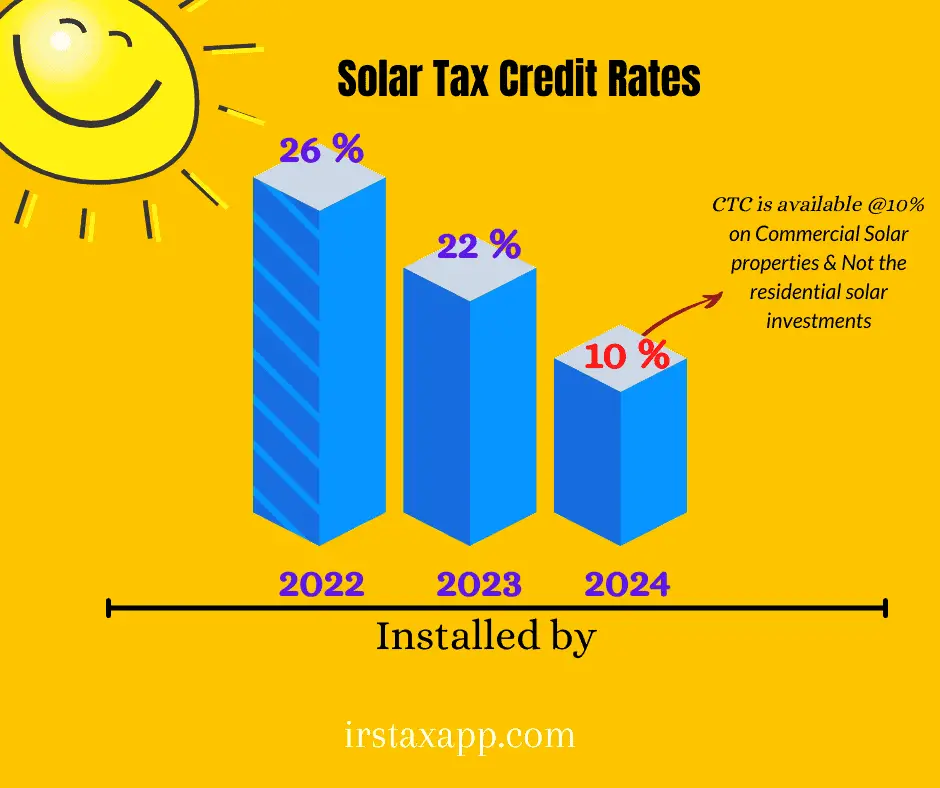

Solar Tax Credit In 2021

The 2021 Solar Tax Credit is a 22% Federal Tax Credit for solar energy systems installed before December 31, 2021. It will decrease to 10% for commercial solar energy systems installed in 2022. After 2022 it expires for home solar energy systems unless Congress renews it. There is no maximum amount that can be claimed.

Can I Claim The Credit Assuming I Meet All Requirements If:

I am not a homeowner?

Yes.You do not necessarily have to be a homeowner to claim the tax credit. A tenant-stockholder at a cooperative housing corporation and members of condominiums are still eligible for the tax credit if they contribute to the costs of an eligible solar PV system. In this case, the amount you spend contributing to the cost of the solar PV system would be the amount you would use to calculate your tax credit. However, you cannot claim a tax credit if you are a renter and your landlord installs a solar system, since you must be an owner of the system to claim the tax credit.

I installed solar PV on my vacation home in the United States?

Yes. Solar PV systems do not necessarily have to be installed on your primary residence for you to claim the tax credit. However, the residential federal solar tax credit cannot be claimed when you put a solar PV system on a rental unit you own, though it may be eligible for the business ITC under IRC Section 48. See 26 U.S.C. § 25D, which specifies that eligible solar electric property expenditures must be for use at a dwelling unit located in the United States and used as a residence by the taxpayer .

I am not connected to the electric grid?

Yes.A solar PV system does not necessarily have to be connected to the electric grid for you to claim the residential federal solar tax credit, as long as it is generating electricity for use at your residence

The solar PV panels are on my property but not on my roof?

Also Check: What Is The Cost Of Tesla Solar Roof Tiles

Savings With The Federal Solar Tax Credit

The federal solar investment tax credit offers immense savings on photovoltaic system installation costs and the faster you begin your project, the more money you can save.

Each year, the federal incentive amount drops:

- In 2019, the credit is 30 percent of the system costs

- In 2020, the credit will be 26 percent of the system costs

- In 2021, the credit will be 26 percent of the system costs

- In 2022, the credit will be 26 percent of the system costs

- In 2023, the credit will be 22 percent of the system costs

- In 2024, the credit will be gone for residential and 10 percent of the system costs for commercial

As long as you own your solar energy system, you qualify for the federal ITC. And if you dont owe Uncle Sam enough to claim the entire credit, you can roll over the remainder.