Learning More About Sc Solar Power Tax Incentives

If you are thinking about installing one of these systems in your home but want to know more about what kind of tax rebates and incentives you might be entitled to, you can get most if not all of your questions answered by choosing a reliable and experienced solar power company.

Blue Raven Solar has knowledgeable staff who are familiar with the tax incentive program in South Carolina and other states. You can find out how much you might be able to recoup out of your own expenses when you file your taxes after your system is installed.

You can also get assistance with filling out the tax forms for the credits by visiting the states energy website at www.energy.sc.gov. You can download the necessary forms, learn more about solar power, and find other helpful resources available for taxpayers who want to take advantage of this credit. The resources are free to download and are updated with each tax season.

As solar power continues to rise in popularity, more homeowners across the U.S. want to invest in solar power. Find out more about what tax incentives you might be eligible for and how to claim them by visiting Blue Raven Solar online today.

Visit our South Carolina page to learn more as well.

Net Metering Policies In South Carolina

Net metering is a wonderful policy that allows solar customers to reduce their solar panel payback period and increase their ROI by offsetting utility bills with excess energy produced by their panels. Net metering is required for most electric companies in South Carolina, but not all. Plus, the buy-back rate isnt mandated, so it varies among providers.

You should check with your electric company on its policy before signing. If you have a less favorable net metering program available, a solar battery might be necessary to offset power bills.

South Carolina Solar Energy Tax Credit

Cut the cost of installing solar on your home by a quarter with South Carolinas state tax credit for solar energy. Residents of the Palmetto State can claim 25 percent of their solar costs as a tax credit and if you dont pay enough in taxes to get the full value of the credit in one year, it carries over for up to 10 years.

Read Also: How Much Does 1kw Solar Panel Cost

Tax Credits And Incentives

South Carolinians with sufficient tax liability can take advantage of federal and state tax credits for the purchase and installation of a solar electric system to reduce the cost.

For a database of tax credits and incentives for solar, visit EnergySaver.SC.GOV.

Important note about tax credits: Tax credits can reduce a consumers tax liability, but the credits are non-refundable meaning that they only apply if a consumer owes enough in taxes to balance the credit. Consumers will not receive a check if they do not owe taxes. Consult a tax advisor.

Summary Of South Carolina Solar Incentives 2022

Palmetto State lawmakers passed a monumental solar bill in 2019, which lifted the states net metering cap and protected the right of homeowners to generate and sell their own electricity! Read on to find out how much you can save with solar in 2021.

There are great incentives for going solar in South Carolina, including both state and federal tax credits, which combined can save you up to half the cost of installing solar panels.

Don’t Miss: Does A Sole Proprietor Have An Ein

Why Go Solar In South Carolina

South Carolina currently ranks 14th in the nation for states that are making the move toward renewable energy. Now, there is enough solar power in South Carolina to power more than 200,000 homes. Quite a bit of this has to do with the state solar tax credit and other incentive programs that help to lower the total costs.

Energy costs in South Carolina can be high because of the temperatures experienced in this state. If you have ever been to South Carolina in the middle of the summer, you may know the Palmetto State can get a little warm. When this happens, the electric bills can be pretty high. In addition, there are many large homes in South Carolina that could use the help of some solar energy efficiency to decrease total costs. Luckily a solar panel system can not only save you money in South Carolina, but it can also make you money with net metering.

What Are The Best South Carolina Solar Incentives Rebates And Solar Incentives

Investing in a solar panel system is not cheap but if youre in the right location with lots of sunshine, it can pay off big time in the long run, providing you with thousands of dollars in savings on energy bills in the next couple of decades.

And with South Carolina solar tax credits and rebates, that investment becomes even more affordable! With that in mind, well explore some of the financial incentives that the state of South Carolina offers to its prospective solar shoppers!

Don’t Miss: How To File For Sole Custody In Nj

What To Know About Incentives

There’s a sense of urgency among Upstate solar companies because state and federal incentives are nearing an end.

Solar installation and equipment can range in price from about $20,000 to $35,000 depending on size, materials, labor and fees. It’s a major investment for homeowners, but the high upfront cost can be offset by generous state and federal tax incentives, which together can cover 55 percent of installation-related costs in South Carolina.

In 2014, South Carolina lawmakers passed legislation to make it more affordable for homeowners to go solar. Around the same time, energy companies were offering rebates and incentives for solar installations. Those have since ended, but the state and federal tax incentives have remained.

Now those incentives could begin tapering off for new customers.

“Incentives are slowly going to start drying up years from now, so there’s really not been a better time to go solar,” Landino from Summit Solar said.

There are two competing bills now working their way through the state legislature that could change South Carolina’s solar industry, The State reports. The House Labor and Commerce Committee supports a bill that would make it more expensive to install solar technology by eliminating subsidies currently offered to solar customers. Another bill supported by the House Judiciary Committee would lift the four-year cap on solar, ensuring solar installations remain affordable.

% South Carolina Tax Credit For Solar Energy Systems

The state of South Carolina offers an additional tax credit for home and business owners who go solar, worth 25% of the total cost including installation.

To claim the South Carolina tax credit for solar, you must file Form SC1040TC as part of your state tax return. The corresponding code is 038 SOLAR ENERGY OR SMALL HYDROPOWER SYSTEM CREDIT: For installing a solar energy system or small hydropower system in a South Carolina facility . Make sure to include this amount and this form with your 2016 Individual Income Tax Return Form SC1040.

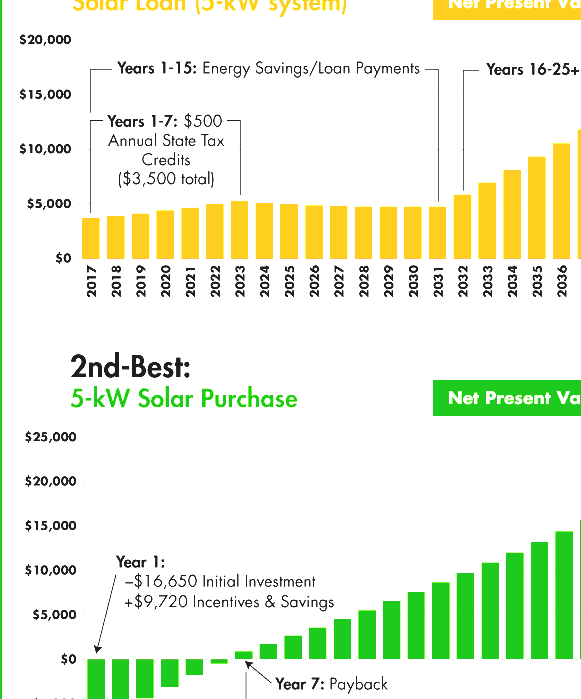

The maximum incentive for the SC state tax credit is $3,500, or 50% of taxpayers tax liability for that taxable year, whichever is less. This credit has no expiration date and any excess credit may be carried forward up to 10 years.

Note: If you installed solar panels after December 31, 2016 you will apply for the solar tax credit next year when you file your 2017 income taxes.

If you havent gone solar yet, you still have until the end of the year to install solar panels so that you can take advantage of these incredible solar incentives! Learn more about solar solutions for the home, or Contact Us to schedule a FREE solar consultation and find out how much you could be saving with solar!

Read Also: How To Estimate Solar System Size

Business Energy Investment Tax Credit

Note: The Consolidated Appropriations Act, signed in December 2015, included several amendments to this credit which applied only to solar technologies and PTC-eligible technologies. However, the Bipartisan Budget Act of 2018 reinstated this tax credit for the remaining technologies that have historically been eligible for the credit.

The federal Business Energy Investment Tax Credit has been amended a number of times, most recently in February 2018. The table below shows the value of the investment tax credit for each technology by year. The expiration dates are based on when construction begins.

| Technology |

|---|

Residential Renewable Energy Tax Credit

Under the Bipartisan Budget Act of 2018 which was signed in February 2018, a number of tax credits for residential energy efficiency that had expired at the end of 2016 were renewed. Tax credits for non-business energy property are now available retroactive to purchases made through December 31, 2017. Tax credits for all residential renewable energy products have been extended through December 31, 2021, and feature a gradual step down in the credit value.

*Disclaimer: The tax credit information contained within this website is provided for informational purposes only and is not intended to substitute for expert advice from a professional tax/financial planner or the Internal Revenue Service .

You May Like: How Much Does A Solar Attic Fan Cost

South Carolina Property Tax Exemptions For Energy

There are no property tax exemptions for installed solar systems in South Carolina. Property tax exemptions allow businesses and homeowners to exclude the added value of a system from the valuation of their property for taxation purposes. An exemption makes it more economically feasible for taxpayer to install a solar system on a residential or commercial property.

Whats The Outlook On Solar In South Carolina

South Carolina generally looks quite favorably on solar energy. The state consumes about double the energy it produces, so any move toward sustainability is welcome.3

Currently, more than half of South Carolinas energy production comes from nuclear energy, and the states Renewable Portfolio Standard goals are lower than most other states, which suggests a lack of interest in clean energy sources.4

However, residential solar installations are significantly more prevalent in South Carolina than they were a decade ago, and utility-scale solar has soared in the past five years. The solar policies and state incentives are all quite favorable, which is a good sign that the solar industry in the area will continue to grow and expand.

Don’t Miss: How Much Do Solar Cells Cost

Work With An Installer

Find a professional for advice and installation.

You’ll work in consultation with an independent solar Installer to assess your site and apply to participate. Once you’ve been approved, you’ll purchase or lease rooftop panels from the Installer for interconnection to the Dominion power grid.

Always use a professional, licensed contractor to install your solar electric system. While Dominion Energy does not endorse any contractors, here are some resources to consider:

The History Of Solar Power In South Carolina

While other states began implementing policies in the 1970s and 80s, South Carlina passed its first policy in 2006 with its Solar Energy Tax Credit. Other policies since then have included the states distributed energy resource program, net metering, and renewable energy credits policies implemented by individual utility companies.

Its safe to say that South Carolinas investments in solar power have paid off. Today, the state ranks 14th in the nation for solar energy generation. Solar power accounts for 2.63% of the states electricity, which is enough to power more than 245,000 homes. Over the past five years, the state has seen an increase in residential, commercial, community, and utility solar installations.

Read Also: Can You Take Solar Credit On Rental Property

How Much Does It Cost For Solar Panels In South Carolina

Solar panels in South Carolina for a complete single-family home will typically range from around $12,000 to more than $20,000. If you have a large home, the solar panels needed to power it will be considerably more extensive, and the total costs will increase. Some homeowners will do a partial installation to keep costs manageable and do the rest at a later time. This can impact eligibility on rebates and incentives, so keep that in mind.

Getting Started With Rooftop Solar

Harnessing the sun’s energy to power your home.

At Dominion Energy, we’re all in on solar. Our solar fleet the 4th largest in the nation powers 450,000 homes with zero-carbon electricity. Rooftop solar is a clean, renewable energy option if customers want to consume their own energy at their home. Read on to see the process for interconnecting your solar system to the Dominion Energy system.

Read Also: Do You Have To Pay For Electricity With Solar Panels

How Do Tax Credits Work

Tax credits are not rebates or cash back. Tax credits allow for you, the homeowner or business owner, to keep money that would otherwise be owed for taxes. To utilize tax credits you must first owe the federal and/or the state of South Carolina taxes at the end of the year.

The maximum annual incentive for the SC state solar tax credit is the lesser of $3,500, or 50% of taxpayers tax liability for the calendar year. In the event that you are unable to utilize all of your available tax credits in the first year, unused tax credits will roll forward up to 10 years.

SolFarm suggests that you speak with a tax professional to fully understand your ability to utilize these tax credits.

Solar Power In South Carolina

South Carolina, on average, sees 216 sunny days annually, which is great for people who want to harness solar power to offset energy costs. South Carolina ranks in the top 10 of states for residential electricity sales per capita because 70% of homes use electricity for heating and nearly all homes use electricity for air conditioning. The Palmetto state offers a terrific state tax credit and net metering, which can further offset initial costs.

You May Like: How Much Are Solar Panels For A House In Texas

Transfer Of Solar Service

Have you bought a home that already has solar installed? Unlike electric, gas and outdoor lighting service, the solar service does not automatically transfer to the new account. it must be applied for by the new homeowner. Once the Transfer of Service application process is completed in our PowerClerk System, the solar generation meter will be reconnected.

You must be the homeowner in order to apply for solar service. If a renter/tenant starts service at a premise that has solar service, they will not be able to have the solar service reconnected and benefit from the solar generation.

When you start the application process you will be asked to provide your contact information, which should match the Dominion Energy’s account holder information. You will need to upload your current Homeowner’s Insurance Policy. Please be sure that the policy contains the following: Insured Name, Start and Expiration Date of the policy, and the Personal Liability coverage of at least $100,000 per occurrence.

Within 3-5 business days of receiving your submitted application, you will receive an email from us via DocuSign. Please read the Interconnection documents and, if you agree, DocuSign will guide you through electronically signing your documents.

Once you have signed your documents, we will reconnect your solar service within 5-10 business days . You will receive an email with your official Approval to Energize, which means you can activate your Solar Energy System.

South Carolina Solar Panel Costs

The average 5-kW solar power system in South Carolina typically ranges between $15,000 to $25,000, depending on the amount of panels, labor, system configuration and any permitting cost. That estimate doesnt include any tax credit or incentive considerations.It takes 8.7 years on average to recoup investment costs through energy savings typically, though the range varies due to energy costs, amount of sunlight a locale receives and incentives.

Read Also: How Much Can Solar Power Generate

Compare Rooftop And Community Solar

Choose the solar program that is best for you.

As part of Dominion Energys commitment to providing customers with renewable energy options, we now offer two ways for our residential customers to go solar: with our Rooftop Solar and Community Solar programs.

Please note that Dominion Energy South Carolina electric customers may participate in either our Rooftop or Community Solar programs, but not both.

Work in consultation with an independent solar installer to apply to participate in our Rooftop Solar program. Once you’ve been approved, purchase or lease rooftop panels from the installer for interconnection to the Dominion power grid.

We offer several rate and billing structures to suit your particular needs:

Solar Choice

Customers will move to the Residential Rate Time of Use Rate. Customers will consume self-generated power and will be credited for excess energy delivered to DESC based upon the on-peak and off-peak periods defined by the Time of use rate. Solar Choice Rider to Residential Rate 5

Offset Only

- Purchase Upfront cost of $2.25/watt $0.10/kWh monthly bill credit

- No upfront cost $0.20/kW monthly fee $0.01/kWh monthly credit

South Carolina Solar Panel Companies

Because green energy is becoming more prevalent in South Carolina, there are more and more companies providing these services. When searching for the best South Carolina solar panel company, be sure to thoroughly research all of your options. Read reviews, ask for customer references, and research the companys history before signing a contract. You can also find solar panel guides and resources with SaveOnEnergy to make the shopping experience clearer.

Read Also: Color Changing Solar Lights With Remote

How Much Sun Does Your Roof Receive

Solar panels produce energy and, therefore, save you money when they absorb sunlight and convert it into electricity. As such, areas with abundant sun exposure are better suited for solar panel installation.

South Carolina residents experience an average of 216 sunny days per year, which is above the national average of 205 sunny days. In terms of sunlight availability, solar panels are more valuable in South Carolina than in most other states.

To determine your homes solar viability, though, you need to assess your property individually, as there are some factors that can make your home more or less suitable for solar conversion. The direction your roof faces, for example, can make a significant difference. South-facing and west-facing roofs in the US are the best for solar panels, as they receive the most sun.

Additionally, you should check your roof for shading from trees and buildings. Any sunlight obstructions can reduce your panels efficiency and, therefore, their value.