The Federal Solar Investment Credit In 2020

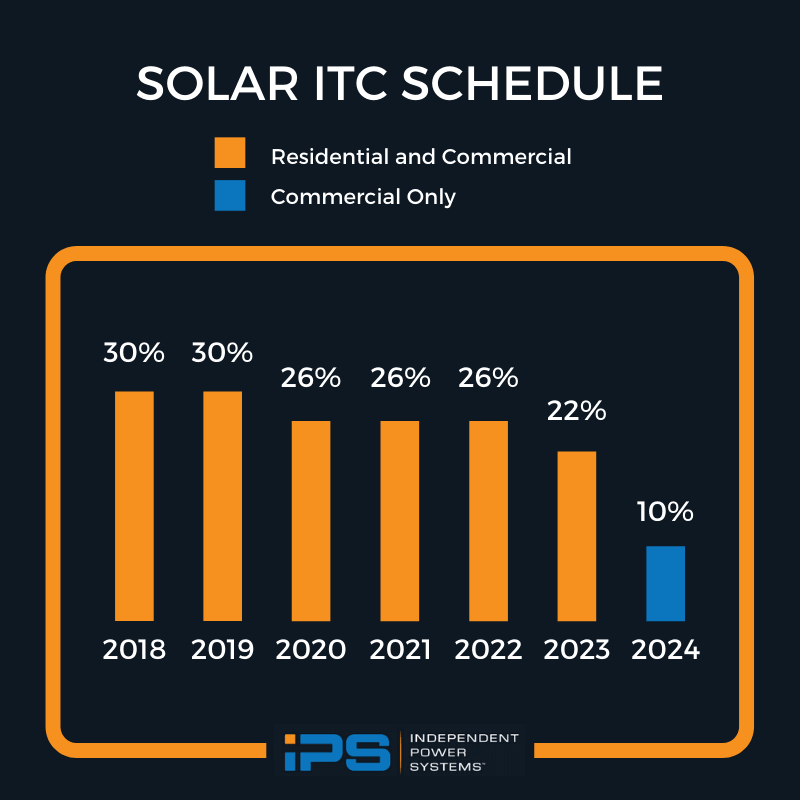

The 2020 Solar Tax Credit is a 26% Federal Tax Credit for solar PV systems installed before December 31, 2020. It will decrease to 22% for systems installed in 2021. And the tax credit expires starting in 2022 for residential solar unless Congress renews it. There is no maximum amount that can be claimed.

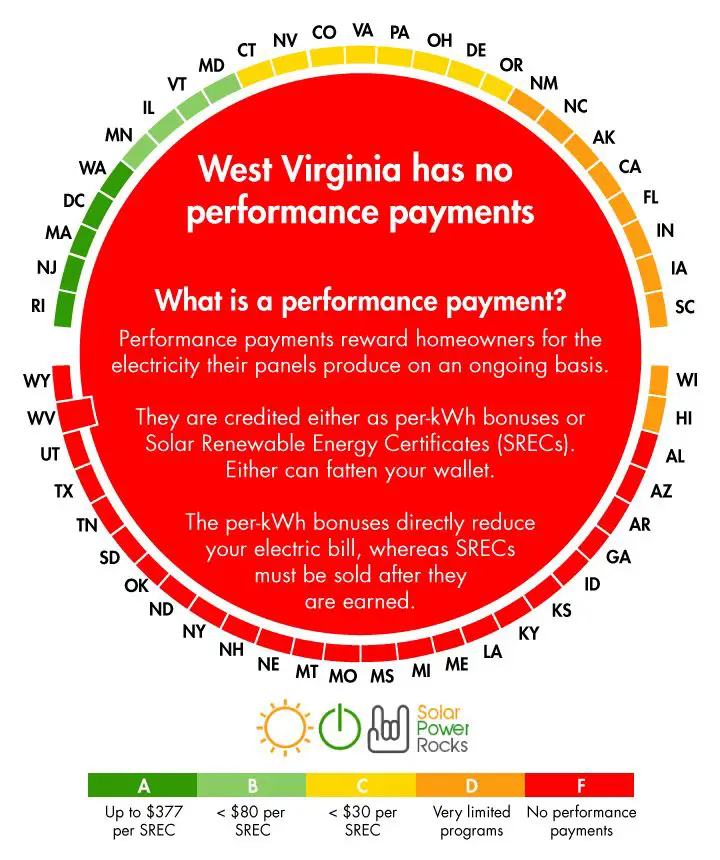

Solar Renewable Energy Certificate

A Solar Renewable Energy Certificate , sometimes referred to as a Solar Renewable Energy Credit, is another type of state-level solar incentive. After you install your solar power system and register it with the appropriate state authorities, they will track your systems energy production and periodically offer you SRECs as a benefit. You can sell your SREC to your local energy utility to provide payment thats typically considered taxable income.

Homeowners Guide To The Federal Tax Credit For Solar Photovoltaics

This webpage was updated September 2022.

Disclaimer: This guide provides an overview of the federal investment tax credit for residential solar photovoltaics . It does not constitute professional tax advice or other professional financial guidance. And it should not be used as the only source of information when making purchasing decisions, investment decisions, tax decisions, or when executing other binding agreements.

You May Like: Do Solar Panels Require Direct Sunlight

What Qualifies For The Solar Tax Credit

- The entire bill for a qualified system, minus the sales tax. That includes solar panels labor costs for on-site preparation, assembly, and installation of the system and piping or wiring to connect the system to your house.

- Installation of a solar system in a primary or second house.

- Systems purchased outright or with a loan.

- Solar roofing tiles, like those being sold by Tesla.

- Solar installed in a property that you live in for at least part of the year. That could cover, for instance, a second home that you rent out when youre not there. The credit is prorated based on how much time you spend in the residence. For a multifamily home in which you live but also collect rent, you may be eligible for either the residential or business tax credit, depending on how much of the property is used for business. Check with a tax expert for details.

Are You Eligible To Claim The Federal Solar Tax Credit

In order to claim the federal solar tax credit and get money back on your solar investment, you have to meet the following criteria when filing your 2021 taxes:

- Your solar PV system must have been installed and began operating at some point between January 1, 2006, and December 31 of 2021.

- Your system must have been installed at either your primary or secondary residence.

- You must own the solar PV system, whether you paid upfront or are financing the cost.

- The solar system must have been used for the first time. You only get to claim this credit once, for the original installation of your solar PV equipment. So if you move residences, take your panels with you, and install them on your new roof, you wont be able to claim a second credit.

You May Like: Diamond Crystal Solar Naturals Water Softener Salt Crystals

How To Get Started With Solar And Claim Your Investment Tax Credit

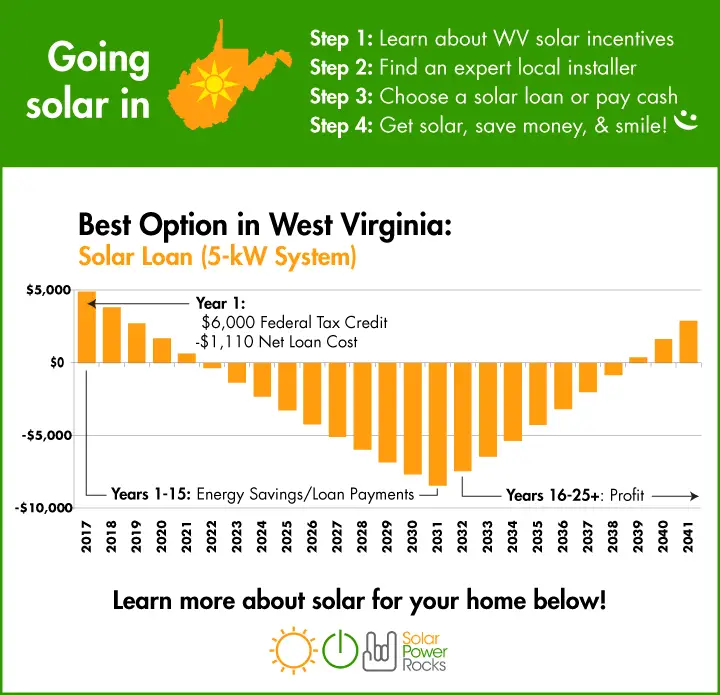

If youve ever considered going solar, and thought about how to get your solar tax credit, then theres never been a better time to get started! The Solar Investment Tax Credit allows you to get money back on your solar energy system, and going solar now will ensure you get the biggest return on your investment while the solar tax credit is still available.

Over the years, the ITC has played an important role in influencing federal policy incentives for clean energy in the United States. The long-term stability of the ITC has allowed businesses to continue driving down costs and investing in their own growth, and by investing in solar, you will be helping create jobs and strengthen the economy, while saving yourself money in the process.

Get started today with a savings estimate from Palmetto, to learn more about how the solar power federal tax credit can help reduce your out-of-pocket expenses. Solar panels are a great way to offset your energy costs and reduce the environmental impact of your home, while giving you energy independence and control over your familys future. Now is the time to install solar and take advantage of the Solar Investment Tax Credit while you still can!

What Does The Federal Solar Tax Credit Cover

According to the EERE, the federal solar tax credit covers the following items:

- Panels: The credit covers solar PV panels or PV solar cells.

- Additional equipment: The credit covers other solar system components, including the balance-of-system equipment and wiring, inverters and other mounting equipment.

- Batteries: The ITC covers storage devices, such as solar batteries, charged exclusively by your solar PV panels. It also covers storage devices activated in a subsequent tax year to when the solar energy system is installed. Beginning on Jan. 1, 2023, stand-alone energy storage that doesnt charge solar panels exclusively will qualify for the ITC credit.

- Labor: Labor costs for on-site preparation, assembly or original solar installation are covered. This includes permitting fees, inspection costs and developer fees.

- Sales tax: The credit also covers sales taxes applied to these eligible expenses.

Also Check: Does Solar Really Increase Home Value

Solar Energy Resources For Consumers

Anyone who uses energyenergy consumerscan take advantage of solar energy to power their lives. These resources, compiled by the U.S. Department of Energy Solar Energy Technologies Office , cover a wide variety of topics, from the process of choosing and installing a solar energy system, to understanding how it impacts the value of a home. Learn more below. Vea nuestros recursos en español.

How Does The Solar Tax Credit Work With State Local And Utility Incentives

The federal tax credit isn’t the only incentive available to homeowners who switch to solar. You could be eligible for other incentives offered by your state government, or even your utility company. The type of incentive could potentially impact how much your federal solar tax credit will be worth.

Recommended Reading: Does Cleaning Solar Panels Help

How To Claim Your Solar Tax Credit

To claim the federal solar tax credit you will need to file an IRS Form 5695 for the tax year that your project was deemed operational, usually by a city inspector.

So, if your solar panels passed a city inspection on August 14, 2023, then you would claim your Residential Clean Energy Credit when you file your 2023 taxes .

Well walk you through the basic process of filing for the federal solar tax credit, but we recommend talking to a tax professional to make sure youre not missing anything.

How Does The Tax Credit Work

You can claim the federal solar tax credit as long as you are a U.S. homeowner and own your solar panel system. You can claim the credit once it will roll over to the next year if the taxes you owe are less than the credit you earn. Keep in mind that the credit is a deduction, not a refund.

For example, if you install a solar panel system for $19,000, youll owe $5,700 less on your federal tax return. If your tax liability is less than $5,700, the remainder of the credit will roll over and be applied to your federal income taxes the following year.

Read Also: How Much Is A Whole House Solar System

The Federal Solar Tax Credit Has Been Extended Through 2023

Ecohouse Solar was excited to learn the federal solar investment tax credit was extended at the end of 2020. The ITC, which was initially going to begin phasing out at the end of 2020, received a much-needed two-year extension.

The extension will provide an extra incentive for going solar until 2023.

Here are a few core points you should know about the Investment Tax Credit :

- The ITC is the federal policy which allows solar system owners to be refunded some of their solar installations cost from their taxes.

- The solar ITC is the primary financial incentive to go solar in the U.S.

- In some cases, it can be used for battery storage as well.

The extension gives everyone more time to take advantage of the Federal solar tax credit.

Instead of dropping to 22% at the end of 2020, the tax credit has been frozen at 26% for all solar projects which commence construction between Jan. 1, 2021 and Dec. 31, 2022. This extension includes residential, commercial, industrial, and utility-scale arrays.

The current plan mandates that in 2023, the tax credit for all solar projects will drop to 22%.

Beginning in 2024, residential projects will no longer receive a tax credit. However, commercial and utility solar projects will retain a permanent 10% credit.

Please contact us for a free proposal:

How To Claim The Tax Credit For Solar Panels

Note: Were solar experts at Palmetto, but everyones tax situation is unique, so please consult with a tax expert to determine whats best for you. That said, if youre looking for information on how to file for a solar panel tax credit, heres a general overview of how homeowners can claim their Residential Clean Energy Credit:

Recommended Reading: How Much Solar Panel Is Needed To Power A House

Extensions To Insurance Subsidies On The Marketplace

In 2021, Congress passed new subsidies aimed at low- and middle-income Americans who buy insurance on marketplaces created by the Affordable Care Act but those subsidies were ready to expire at the end of this year. The new law will extend those subsidies by three years.

This will help keep more people insured and keep premiums lower for people who purchase insurance on the marketplace, as opposed to employer-sponsored healthcare plans. After the new subsidies were added by Congress in 2021, a record number of people signed up for health insurance through the marketplace, and premiums fell by 19 percent between 2021 and 2022, according to the Department of Health and Human Services. An estimated 3.1 million people would lose their healthcare plans if Congress had let the subsidies expire, according to an Urban Institute analysis.

Federal Solar Tax Credit Guide

In this article:What is it?| How does it work?| Do I qualify?| What does it cover?| The bottom line|FAQs

Since 2005, the federal government has incentivized homeowners to switch to solar through the solar investment tax credit , also known as the federal solar tax credit. The rate of this credit has fluctuated over the years, but currently lets homeowners claim 30% of their total solar system installation costs as a deduction on their federal taxes. The ITC will decrease to 26% in 2033 and drop to 22% in 2034. It will end in 2035 unless Congress renews it.

We at the Home Media reviews team have researched the best solar installation companies in the United States to understand the industry and available incentives. This guide covers how to qualify and file for the federal solar tax credit and how to file for it so you can save more on your solar power system.

Get a Quote on Your Solar Installation in 30 Seconds

Also Check: How To Make A Camper Solar Powered

Filing Requirements For The Solar Tax Credit

To claim the credit, you must file IRS Form 5695 as part of your tax return. You’ll calculate the credit on Part I of the form, and then enter the result on your 1040.

- If in 2021 you end up with a bigger credit than you have income tax due a $3,000 credit on a $2,500 tax bill, for instanceyou can’t use the credit to get money back from the IRS. Instead, you can carry the credit over to the following tax year.

- If you failed to claim the credit in a previous year, you can file an amended return to claim the credit.

Currently, the residential solar tax credit is set to expire at the end of 2023. If you’re thinking about adding solar energy to your home, now might be the right time to act.

TurboTax will search over 350 deductions to get your maximum refund, guaranteed. If youre a homeowner, TurboTax Deluxe gives you step-by-step guidance to help turn your biggest investment into your biggest tax break.

Going Solar Just Got Easier

The new and improved federal solar tax credit has been met with a collective sigh of relief from a solar industry that was racing to squeeze customers in before the previous tax credit stepped down and expired.

Now, the 30% tax credit is here until 2032 and the long term savings of solar in reach for more Americans. In addition, the Inflation Reduction Act made significant investments in American solar manufacturing, which should help to further drive down the costs and increase the benefits of going solar.

With that said, now that the tax credit is at 30%, the best time to go solar is yesterday. The sooner you start producing energy, the sooner youll start saving.

Don’t Miss: Can You Take Solar Panels With You When You Move

Federal Tax Credit For Solar Panels 2022

Hawaii Renewable Energy Technologies Income Tax Credit

The Hawaii Department of Taxation oversees the Hawaii Renewable Energy Technologies Income Tax Credit.

Database of STATE Renewable Energy and Energy Efficiency Incentives Available in Hawaii

The Database of State Incentives for Renewables & Efficiency , maintained by the North Carolina Clean Energy Technology Center and originally funded by the United States Department of Energy, is a free and open resource providing a searchable database of incentives and policies available for clean energy in each state.

Hawaii Enterprise Zones

Currently, wind energy producers may be eligible for this incentive that provides a 100% general excise tax exemption as well as reductions in state income taxes in exchange for demonstrated job growth. This incentive is available statewide in designated geographic areas.

Hawaii Foreign Trade Zone

Hawaiis Foreign Trade Zone Program supports manufacturing and small business activity in Hawaii by encouraging companies to compete in export markets and providing growth to new companies that import and export merchandise, including renewable energy and energy efficiency equipment.

Renewable Fuels Production Tax Credit

How Big Of A Difference Is A 26% Tax Credit Versus A 30% Tax Credit

Since the federal solar tax credit is applied to your solar arrays gross system cost, the amount you receive is dependent on the amount of solar youre purchasing: bigger system, bigger credit.

Heres a quick example of the difference in credits in 2021 and 2022 for a 9 kW solar array at an average cost of $27,000.

- Installed and claimed in 2021 taxes at the 26% level, your credit would be $7,020.

- Installed and claimed in 2022 taxes at the full 30% level, your credit would be $8,100.

Thats a savings difference of $1,080, equal to a years worth of $90 utility bills.

Recommended Reading: How To Pigeon Proof Solar Panels

Tax Credits For Drivers Who Buy Electric Cars

The bill includes a credit to help consumers purchase an electric vehicle but it has some major caveats.

Any individual who makes less than $150,000 or $300,000 for married couples can take advantage of a $7,500 credit to buy a new EV or up to $4,000 for a used version. But the bill specifies that the EV batteries must be sourced in certain amounts from North America and the United States trading partners. These requirements are being phased in over time, but even right off the bat, the Alliance for Automotive Innovation estimates that of the 72 currently available EVs, only 20 to 25 of them would be eligible. Over the next few years as the sourcing requirements ramp up, the Alliance says that none of the models would be eligible.

These specifications might push the industry to change its practices and phase down its reliance on Chinese materials and labor faster, but for the moment it does seem to leave many consumers out of luck.

Read Also: How Much Does It Cost To Register A Sole Proprietorship

What Does The Solar Tax Credit Cover

Taxpayers who installed and began using a solar PV system in 2022 can claim a federal tax credit that covers 30% of the following costs:

- Cost of solar panels

- All additional solar equipment, such as inverters, wiring and mounting hardware

- Labor costs for solar panel installation, including fees related to permitting and inspections

- Energy storage devices that are powered exclusively through the solar panels, including solar batteries

- Sales taxes paid for eligible solar installation expenses

You May Like: What Size Charge Controller For 300w Solar Panel

How Is The Federal Solar Tax Credit Calculated

The equation for figuring out how much your solar tax credit is worth is simple.

Gross cost of project x 0.30 = tax credit value

So if your project costs $30,000, your tax credit will be worth $9,000 .

The gross system cost may include improvements needed to facilitate the solar installation, such as electrical box upgrades. However, its best to speak to your tax advisor about your unique circumstances.

The credit is a dollar for dollar income tax reduction. This means that the credit reduces the amount of tax that you owe. It also means that you have to pay and file taxes in the same tax year order to receive the credit.

Now that we know how to calculate your solar tax credit, lets go over how to claim it.