Solar Incentives Available In Maryland

Net Metering

Solar Renewable Energy Credits

The Maryland Energy Administration offers a rebate of up to $30,000 for qualifying rooftop commercial solar systems, up to $20,000 for non-rooftop commercial systems, and up to $1,000 for qualifying residential systems through the Clean Energy Grant program.

Tax Exemptions

Getting The Best Deal On A Solar System

The cost of solar energy has dropped by 82% between 2010 and 2019 While its rapidly becoming more affordable and provides homes and businesses the free electricity for 25 to 30 years or more, it can still be a significant investment.

Incentives like net metering, SRECs, tax credits, grants, and tax exemptions all make this investment a little bit easier to make. Some states have a plethora of incentives to entice new solar owners, and some states do not. Regardless, solar can be an extremely profitable investment for your home, business, or farm.

While its easier to put off big decisions until youve gathered enough information, time is running out on one of the biggest solar incentives – the solar investment tax credit by the federal government. 2021 is the only year homeowners and businesses can save 22% on their solar system.

For more information on incentives for your state, visit DSIRE.com.

Solar Panels Can Help You Cut Back On Costs On Your Taxes

In addition to increasing the value of your home, solar panels can also help you save money on your taxes. The federal government offers a tax credit for homeowners who invest in solar panels. Many states also offer additional incentives as well. Check with your local tax advisor to see what credits and incentives are available in your area.

Don’t Miss: How Much To Add Solar Panels To House

Which Solar System Is Right For Your Home

From small systems that can power one or two major appliances, to large systems that can power an entire large house, there are several different types of solar systems. Each is powered by photovoltaic components that collect energy. If youre considering switching to solar energy in Connecticut, youll want to consider variables like the size of your roof, how much energy your family typically consumes and your budget to determine the right type of solar system for your home.

Compare Quotes From Top-rated Solar Panel Installers

Free, No-commitment Estimates

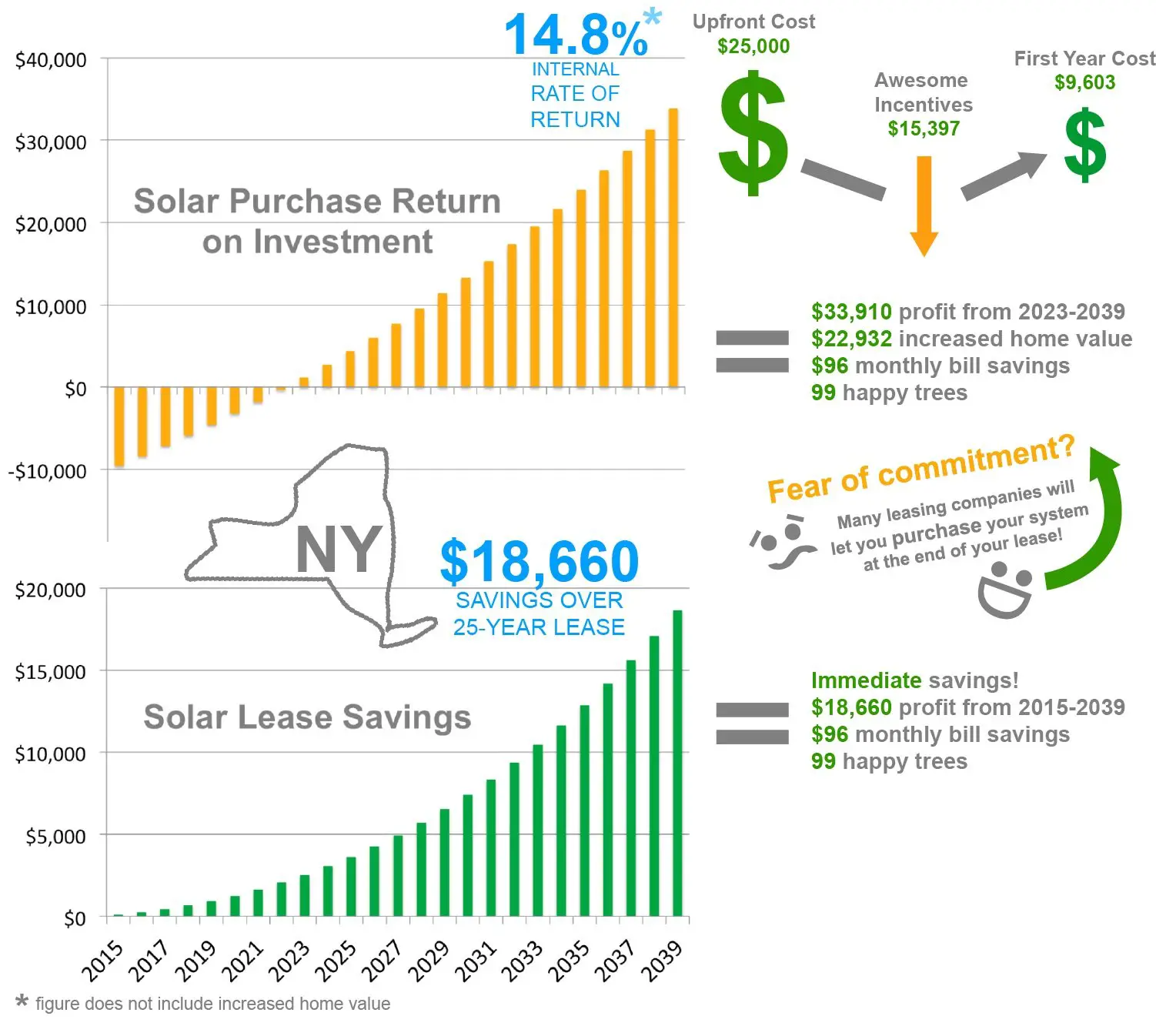

Solar Incentives Available In New York

NY Value Stack: Net Metering Alternative

While many states use net metering as a way to compensate solar producers, New York transitioned to what they call the VDER Value Stack. This program aims to more fairly compensate solar producers for their energy because electricity generated by solar has a different value than electricity generated by traditional, non-renewable means.

VDER Value Stack takes into account the following: energy value, capacity value, environmental value, demand reduction value , and locational system relief value . Depending on how these values play out for your specific situation, you may end up earning more or less per kWh than you would with retail rate net metering.

Were not able to fully do this topic justice here, but you can learn more about the VDER Value Stack in this blog.

Tax Credits and Grants

New York doesnt have an SREC market. However, it does offer grants and other incentives that certainly make up for it.

The NY State Solar Energy System Equipment Tax Credit is available to homeowners installing solar and offers a 25% tax credit and maxes out at $5,000.

The NY-Sun Megawatt Block Program offers up to $1,000/kW installed by businesses and homes alike. However, this rate will vary based on how much solar energy is already installed in your area.

If youre a National Grid customer and youre installing solar on a property that produces food you can qualify for additional grants. The more you invest in your system, the more youll save:

Read Also: Federal Solar Tax Credit 2021 Irs

Investment Tax Credits For Solar Energy

Of all the solar incentives available, the one uniformly available program to all Americansno matter which state they live inis the solar tax credit, otherwise known as the Investment Tax Credit . This tax credit is a dollar-to-dollar reduction of your total income tax, meaning for every ITC dollar you claim, that same amount reduces your tax burden.

According to the current guidelines, solar photovoltaic systems you have installed during 2021 are eligible for a 26% solar tax credit, with that amount dropping to 22% in 2023 before ending in 2024. The 26% rate applies to the solar PV panels and contracting costs, storage devices like batteries, balance-of-system equipment such as inverters, and sales tax assessed on certain items.

However, there are some limitations. As mentioned before, to take advantage of these solar incentives, you must be the solar power system owner, whether its installed on a primary or secondary residence within the United States or as part of a qualified community solar project. The system must be new and fully installed by the end of the year. You wont receive the tax credit if youve purchased but have not installed a solar panel kit. Finally, you must have bought the system yourself, either in cash or with solar financing, although any fees and charges are not eligible for the tax credit.

Why Are Solar Panels A Good Investment For Homeowners

There are a lot of compelling reasons to go solar these days. The price of going solar has dropped significantly in recent years. These price drops have made solar more affordable for the average homeowner. In addition, many state and local governments offer incentives to switch to solar energy. These incentives can further offset the cost of going solar and make it even more financially attractive.

Are solar panels worth it? The answer may depend on your individual circumstances. In general, however, the answer is yes. Overall, solar panels are definitely worth the investment. Here are some of the key reasons why solar panels are a wise investment for homeowners.

Don’t Miss: How To Make My House Solar Powered

What Solar Incentives Are Currently Offered In Pennsylvania

First, we want to provide a quick overview of the solar incentives available in Pennsylvania, and the table below will do just that. Well also include more details about each PA solar incentive further below.

Pennsylvanias Renewable Portfolio Standard goals came to an end in 2021, but the state has set up pro-solar programs that are still in place and will benefit any homeowner converting to solar. Well discuss some of the other statewide solar incentives that help keep this clean energy solution a sound investment despite the lack of a state solar tax credit.

Connecticut Green Bank Residential Solar Investment Program

This program offers incentives and cash rebates for both owners and lessees of solar power, which is somewhat uncommon . Under this program, owners of solar systems can enjoy a cost reduction of $0.426 per installed watt based on system size. Those who lease their system can get compensation of $0.30 per kilowatt hour generated.

Recommended Reading: How To Apply Solar Tax Credit

Tax Credits & Financing

Consult your tax professional to see if you are eligible for The Federal Investment Tax Credit of up to 30% off your qualified system and installation.

If upfront costs are keeping you from pursuing solar solutions for your home or business, you may want to explore leasing or entering a power purchase agreement . Youll negotiate an annual rate, and your vendor will install and maintain your equipment.

Check with your financial institution to see if you qualify for green loans, home equity loans, personal loans or other financing options to invest in and install solar or renewable energy. Your contractor may be able to recommend a lender as well.

Property & Salestax Exemption For Solar

Even though solar increases the value of your home and allows for greater marketability, that extra value isexempt from property taxes in New Mexico. A property tax exemption makes it more economically feasible for a taxpayer to install a solar system on a residential or commercial property you get the financial benefits of generating your own power, without having to worry about a higher tax bill!

New Mexico also offers state sales tax exemptions for solar panel installation. A sales tax exemption means that homeowners and businesses would not have to pay any additional state sales tax on their solar panel system.

AVERAGE SAVINGS VALUE OF PROPERTY TAX EXEMPTION: Variable

AVERAGE SAVINGS VALUE OF SALES TAX EXEMPTION: $1,750

Recommended Reading: Does Hail Damage Solar Panels

% Federal Solar Incentives

Good news for this incentive. The Inflation Reduction Act of 2022 extends the 30% federal tax credit until 2032, decreasing to 26% in 2033, and dropping to 22% in 2034 before finally disappearing entirely in 2035 unless there is an action taken again by Congress to extend it. This new law supersedes the previous one that would expire this incentive in 2024.

Is Solar Worth It In Washington State

While going rooftop solar may not be for everyone, with the incentives available to both home and business owners in Washington, we see it make sense to more and more consumers every day! Let us help you determine whether it may be a good fit for your lifestyle and situation. We specialize in getting you the maximum savings possible given available incentives.

Find out how much we may be able to save you, by giving us a call at 313-7910 or by filling out a free consultation form to have one of our consultants reach out.

Recommended Reading: Will Solar Panels Work During Power Outage

New York State Solar Incentives 2022

As of August 2022, New York’s electricity price averaged 24.9 cents per which was 49.1% higher than the national average of 16.7 cents per KWh, according to the US Bureau of Labor. This does explain the rapid increase of solar panel installation in the Empire State.

What are the best solar panel incentives, and how do they lower your cost? Ready! Let’s begin.

Durham Solar Power Faqs

- How much would solar cost in Durham?

Two direct factors that affect the price of solar arrays are installation costs and solar system sizes. The median cost in North Carolina for a solar array is $4.63 per watt. A standard 7 kW panel would then cost just under $23,000 after factoring in the federal tax credit.

- Is solar power a good investment in Durham?

Solar power is popular because it can offer long-term savings. You could save nearly $7,000 over 20 years with solar based on North Carolinas average electric rate, the 30% tax credit, and median state costs. Energy prices also typically rise with time, meaning your electricity bill savings could gradually increase.

- Where can I find good solar panel installation in Durham?

You can connect with a trusted solar installer near you by filling out the form on this page. SaveOnEnergy partners with local installers that are ready to help interested homeowners. The installer can then help you understand financing options and determine the proper array size and type for your home.

- How does solar power help the environment?

If you want to cut back your carbon footprint, installing solar is a direct way to do so. Solar power does not emit carbon dioxide, unlike oil or coil. You can learn more about solar and how it helps the environment in our guides on solar energy and its renewability

Don’t Miss: How To Figure Out How Many Solar Panels I Need

What Solar Panel Incentives Are Available In Your State

A solar system will produce free electricity for your home, business, or farm for decades. In just a few years, your solar system can pay for itself. From then on, its decades of free electricity.

Going solar is a long-term investment that requires money upfront to cover the installation cost. The good news is that there’s help available. Federal and state governments have made it easier to install solar through a series of incentives. Whether theyre tax credits, grants, or something else entirely, theyll put money back in your pocket as early as the first year you install your system.

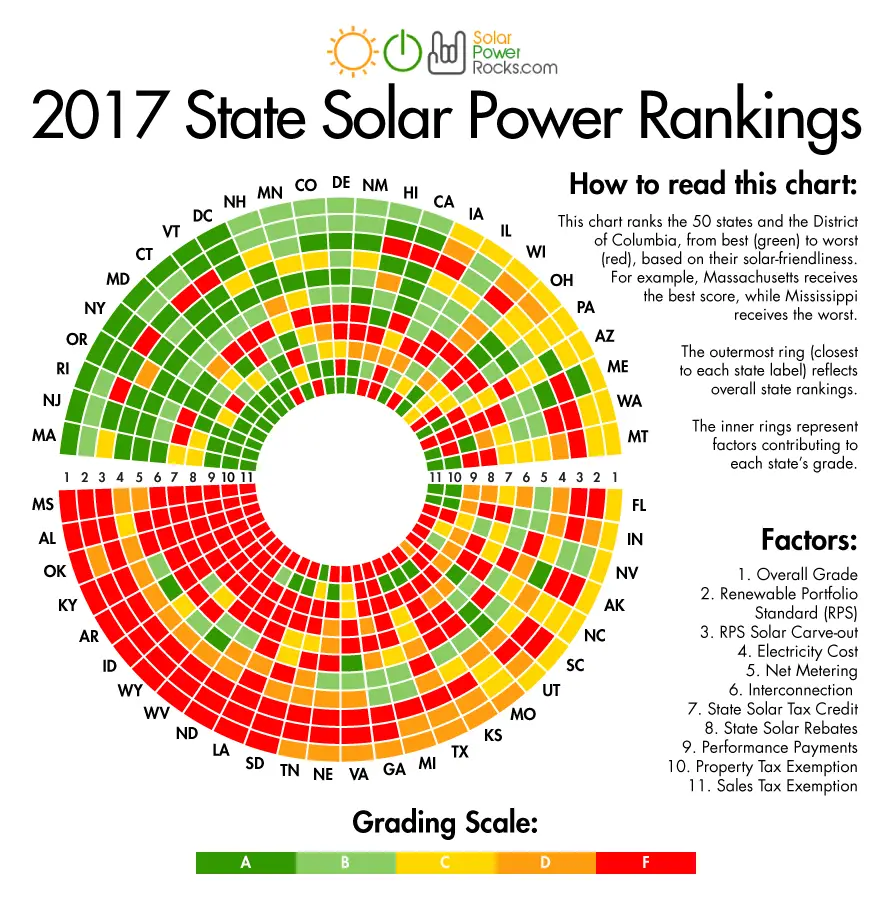

While federal incentives stay the same across the board, incentives on a state level vary quite a bit. Weve done the work and outlined the best solar incentives for each state we service.

Solar Incentives Available:

What Solar Power Incentives Does Your State Offer

Just 100 years ago the majority of people didnt have electricity in their homes at all. The only way to electrify a home was to tie into the grid once it finally reached your location.

Today there are still homes that are far off the grid, but owners dont have to resort to gas lanterns. Most homes can now be powered partially or completely by solar panels. One of the biggest hurdles to going solar is the cost. The average solar panel system costs around $16,000.

Homeowners that go solar enjoy energy independence, even when theyre still tapped into the grid. They also like knowing that they are minimizing their impact on the environment. And of course, getting power from the sun is free so there can be financial benefits as well once the system is installed.

One thing that makes a solar panel system more cost-effective is state incentives. These are special rebates and tax credits that offset the cost of installing a solar panel system. Some state governments offer solar power incentives to encourage more homeowners to make the switch. Doing so helps state governments lower emissions and reduces strain on electric grids that are often pushed to their limits.

However, not all states have solar power incentives. Heres how to find out if your state has solar power incentives like rebates, tax credits and tax exemptions.

States That Have Solar Power Incentives

Wyoming

Read Also: How To Become A Solar Power Technician

Guide To Solar Incentives By State

When it comes to buying solar panels for your home,weve got good news and better news: the cost of solarpower has fallen over 70 percent in the last 10 years,and there are still great solar rebates and incentivesout there to reduce the cost even further.

The first and most important solar incentive to knowabout is the federal solar tax credit, which can earnsolar owners 30% of the cost to install solar panels backon their income taxes in the year after installation.

States and utility companies also offer several types of solarincentives, and whether you qualify to claim them depends onwhere you live and other factors like your tax status.

On this page, you can learn about the different types of solarincentives available to homeowners. You can also choose yourlocation below to discover the exact mix of solar incentivesoffered by your state and utility companies in your area.

How Long Will There Be Solar Incentives In 2022

The Federal Solar Investment Tax Credit will be available until 2024. However, the tax credit percentage is estimated to decrease in the upcoming years.

Solar panel systems that are installed in 2022 will be eligible for a 26% tax credit. However, systems that are installed in 2023 will receive a 22% tax credit. A tax credit helps decrease the amount of taxable income you would owe. For instance, getting a $500 federal tax credit minimizes the due tax by $500. To get the credit for either year:

-

The solar panel system must be owned, not leased.

-

The system must be for your primary or secondary residence.

-

The home must be located in the U.S.

Theyre pretty easy requirements for most homeowners to meet, and your solar panel installers should be able to help you get everything submitted.

Read Also: How To Hook Up Multiple Solar Panels

How Do Other Incentives I Receive Affect The Federal Tax Credit

For current information on incentives, including incentive-specific contact information, visit the Database of State Incentives for Renewables and Efficiency website.

Rebate from My Electric Utility to Install Solar

Under most circumstances, subsidies provided by your utility to you to install a solar PV system are excluded from income taxes through an exemption in federal law. When this is the case, the utility rebate for installing solar is subtracted from your system costs before you calculate your tax credit. For example, if your solar PV system installed in 2022 cost $18,000, and your utility gave you a one-time rebate of $1,000 for installing the system, your tax credit would be calculated as follows:

* 0.30 = $5,100

Payment for Renewable Energy Certificates

When your utility, or other buyer, gives you cash or an incentive in exchange for renewable energy certificates or other environmental attributes of the electricity generated , the payment likely will be considered taxable income. If that is the case, the payment will increase your gross income, but it will not reduce the federal solar tax credit. Note: A private letter ruling may not be relied on as precedent by other taxpayers.

Rebate from My State Government

$18,000 * 0.30 = $5,400

State Tax Credit

Other Frequently Asked Questions

If the tax credit exceeds my tax liability, will I get a refund?

This is a nonrefundable tax credit, which means you will not get a tax refund for the amount of the tax credit that exceeds your tax liability. Homeowners may get a tax refund at the end of the year due to the tax credit, if the reduction in tax liability means there was overpayment during the year. This can often occur when employers deduct taxes for employees over the course of the year. However, such refund is still limited by the taxpayers total tax liability. However, you can carry over any unused amount of tax credit to the next tax year.

Is the cost of a roof replacement eligible for a tax credit?

Sometimes. Traditional roof materials and structural components that serve only a roofing or structural function do not qualify for the credit. However, some solar roofing tiles and solar roofing shingles serve both the functions of solar electric generation and structural support and such items may qualify for the credit.

Can I use the tax credit against the alternative minimum tax?

Yes. The tax credit can be used against either the federal income tax or the alternative minimum tax.

I bought a new house that was constructed in 2022 but I did not move in until 2023.

May I claim a tax credit if it came with solar PV already installed?

Also Check: The Planets Of Our Solar System