An Example Of Solar Depreciation Benefits

Lets figure out the MACRS depreciation for a solar system that costs $300,000 before incentives. As long as you install this system in 2021, youll be able to take advantage of the Federal Solar Incentive Tax Credit at 26%. But since we have to calculate depreciation with half of the tax credit reducing the depreciable cost basis, well have to take 13% off the cost of the system to get the basis of depreciation. We can do this by multiplying the cost by 87%, which gives us $261,000.

Next, youll need to know your federal and state tax brackets. For this example, well use a 24% federal tax rate and a 7% state tax.

To calculate federal tax savings from depreciation, multiply the $261,000 by 24%. Because you can take advantage of 100% of this in the first year, youll enjoy $62,640 in tax savings the year that your solar system is placed into service.

To get state savings, multiply $261,000 by your state tax rate, which in this case is 7%. Youll get $18,270 spread over the 5-year MACRS schedule..

That means a total savings from depreciation of $80,910. In this example, thats just about 27% of the entire systems cost!

You wont get all of this in year one, but you will get most of it! With 100% bonus depreciation, you will receive all of the federal depreciation and the first years state depreciation according to the five-year MACRS schedule as follows:

| Recovery Year |

Energy Credit For Rental Property

An energy credit for rental property is a tax credit that allows landlords to offset a portion of the cost of energy-efficient improvements to their rental properties. The credit is available for a variety of energy-saving measures, including insulation, windows, doors, and heating and cooling systems. The credit is claimed on the landlords annual income tax return.

Get An Exact Quote From Our Solar Advisors

The SaveOnEnergy marketplace helps you search, compare, sign up and save on the right energy fit for your home all for free. If youre interested in solar, answer a few questions to get an exact price quote from our solar advisors.

1. Complete the form below2. Schedule an appointment with a solar advisor3. Get an exact price quote for solar panels for your home

Read Also: How Much Do Commercial Solar Panels Cost

Solar Tax Credit Can Help You Save On Your Taxes

The IRS provides a tax credit of up to 15% for qualified taxpayers who install solar panels on their homes to generate electricity. The credit is based on the amount of electricity generated by your solar panels, with credit being available in 2021, 2022, and 2023. Regardless of whether you itemize your deductions or not, you can claim the credit and your tax liability will not be affected. If you claim the credit, you can reduce your tax liability. To claim the credit, you must file Form 5695.

Other Ways To Share The Benefits

For rental properties that are not eligible for a Solar Victoria rebate, another option is for both the landlord and tenant to equitably contribute to the cost of the solar system.

A solar savings calculator such as the Victorian Energy Compare Solar Savings Calculator can help to determine a fair contribution from landlords and tenants, based on energy savings tenants will see from the solar system. The tool calculates the estimated bill savings for the tenant based on the solar system size and energy usage. Landlords and tenants could negotiate a tenant contribution that is less than the bill savings.

There are rules governing how often and for what reasons rent can increase, and these may affect repayment agreements between landlords and tenants. These rules are specified in the Residential Tenancies Act.

When negotiating any changes to rent or landlord-tenant agreements outside of the Victorian governments Solar Victoria scheme, make sure they comply with regulations, and seek independent advice as needed.

Tenants Victoria provides information and advice to renters, and Consumer Affairs Victoria has more information about renting and associated regulations.

Recommended Reading: Solar Farm Profit Per Acre

Qualifying For The Solar Tax Credit

Many types of homes and apartments qualify for the Solar Tax Credit, including single-family homes, mobile and manufactured homes, apartments and condominiums. Other less-traditional structures, such as houseboats, and cooperative apartments can qualify for the Solar Tax Credit as well.

You can even claim the Solar Tax Credit for rental properties you own, as long as you live there for a portion of the year. In this case, the percentage you can claim will depend on the amount of time you reside in your rental property each year. For example, if you live at your rental property for half of the year, and rent it out the other half of the year, you will be allowed to claim 50% of the tax credit.

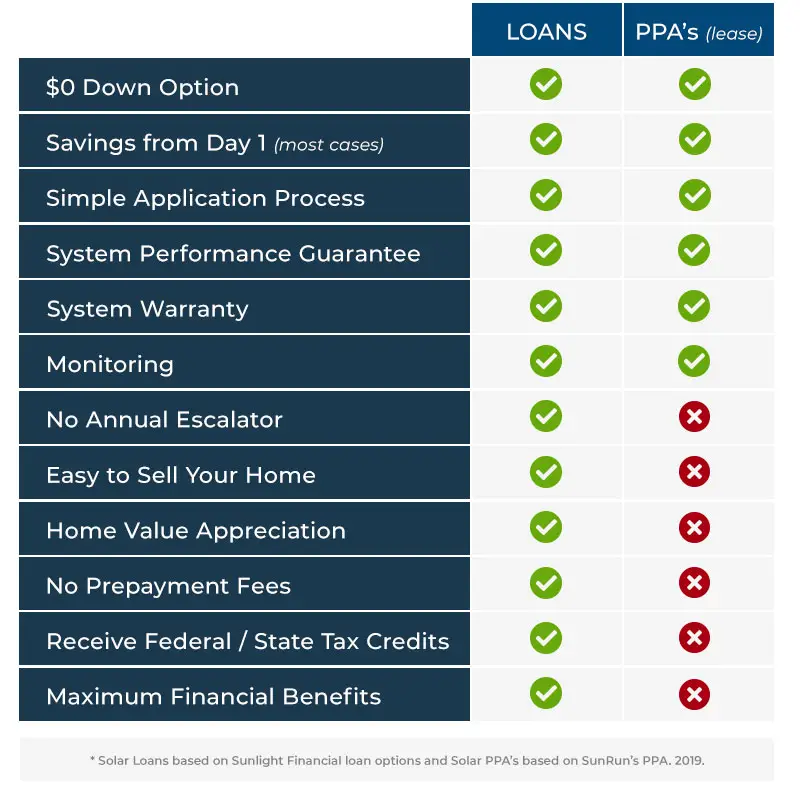

However, solar consumers who lease their system or enter into a solar power purchase agreement , are not eligible for the Solar Tax Credit, which is only available if you purchase your solar energy system. If you do not own your solar setup, then the company that owns it is able to claim the Solar Tax Credit.

Get The Neighborly App

In addition to Real Property Management’s expert skills in managing your rental property, you can utilize Neighborly’s other brands to maintain and enhance your home. Use the Neighborly App to get connected to local home service professionals. Download and receive offers only available on the App.

Depending on current health and safety regulations in your area, some of the services mentioned in this post may not be available. Neighborly service providers will follow the latest health and safety guidelines provided by the local and state governments. Please check with your local Neighborly service provider for details at the time you need service.

Also Check: How Much Is Solar Panels Cost

What Costs Qualify For The Federal Solar Tax Credit

Most, if not all, of the costs associated with installing solar panels are eligible to be covered by the federal solar tax credit. Qualified costs include:

- Equipment: The cost of the solar panels, racking, wiring, and inverters.

- Contractor labor: The cost of labor associated with site preparation, installation, and planning, as well as the cost of any permitting fees and inspections.

- Sales tax: Any sales tax associated with the above costs is also covered by the tax credit.

Technically, the tax credit isn’t just for solar installations. Other clean energy systems can also get the tax credit, including solar water heaters, fuel cell systems, geothermal heat pumps, and even small wind energy systems!

The Solar Tax Credit Program: Not As Beneficial As It Seems

An audit by the Treasury Departments tax administration inspector general recently found that the IRS does not have the ability to track and account for home energy tax credits. According to IRS regulations, taxpayers are not required to provide third-party documentation proving that qualifying home improvements were made or that improvements to the principal residence were made. The solar tax credit, which is intended to encourage solar installation, may not be available to taxpayers who are ineligible. The solar tax credit is only available to taxpayers who owe federal income taxes for the current fiscal year. You may not be able to claim the solar tax credit if you are on a fixed income, retired, or work part-time during the year. If you invest in solar panels, you may be eligible for a solar investment tax credit. This tax break cannot be claimed by the taxpayer. Instead of owing taxes, you will receive a reduction. This credit is available in the tax year for the installation of a solar photovoltaic system. Credit can be claimed as a deduction on your federal income tax return or as a credit against your tax liability depending on the credit. The Solar Tax Credit Program does not issue refunds to ITC recipients, but you may receive one if you overpay taxes due to the credit.

Don’t Miss: How Much Is Solar Energy Cost

History Of The Solar Tax Credit

The Solar Tax Credit was created in 2005 and originally offered 30% tax credits. In 2020, the tax credit was lowered to 26%. In August 2022, the Inflation Reduction Act raised the Solar Tax Credit back to 30% for another 10 years.

The price of residential solar panels has steadily declined since the launch of the tax credit. According the the Lawrence Berkeley National Laboratorys Tracking the Sun report, solar panel costs have dropped by more than 50% in the last decade. So, the value of the Solar Tax Credit in 2022 is even greater than in past years.

Solar ITC by Save On Energy

Purchased Solar For Rental Property And Where Do Get My Tax Credit

Business credit

While Sec. 25D does not allow a solar tax credit for the cost of installing solar panels for use in residential rental property, Sec. 48 is more favorable. Sec. 48 provides for a solar energy tax credit for the installation of solar panels as part of the general business credit under Sec. 38. Under Sec. 48, property that is eligible for the general business credit is tangible property for which depreciation is allowable. Solar panels installed for use in residential rental property meet this requirement.

Also Check: How Long Do Batteries For Solar Panels Last

Solar Investment Tax Credit: What Changed

President Biden signed the Inflation Reduction Act into law on Tuesday, August 16, 2022. One of the many things this act accomplishes is the expansion of the Federal Tax Credit for Solar Photovoltaics, also known as the Investment Tax Credit . This credit can be claimed on federal income taxes for a percentage of the cost of a solar photovoltaic system.

Lets take a look at the biggest changes and what they mean for Americans who install rooftop solar:

- The ITC increased in amount and its timeline has been extended. Those who install a PV system between 2022 and 2032 will receive a 30% tax credit. That will decrease to 26% for systems installed in 2033 and to 22% for systems installed in 2034. If youve already installed a system in 2022, your tax credit has increased from 22% to 30% if you havent already claimed it.

- The solar+storage equipment expenses included in the ITC have expanded. Now, energy storage devices that have a capacity rating of 3 kilowatt hours or greater are included. This includes stand-alone storage, but heres why you should pair it with solar.

The ITC will cut the cost of installing rooftop solar for a home by 30%, or more than $7,500 for an average system. By helping Americans get solar on their roofs, these tax credits will help millions more families unlock an additional average savings of $9,000 on their electricity bills over the life of the system.

Do Solar Panels Increase Your Rental Property Value

Yes, solar panels can increase rental property value. As the owner of the rental property, were guessing that youll want to do what you can to make the best financial decision.

A rental property is intended to be a way for you to maximize profit and keep your initial investment as low as possible. Thats why you might be interested to know that solar could increase rental property value.

The whole purpose of having a rental property is to reap the financial benefits. If there comes a time when you want to sell the property, a solar upgrade adds significant value to your investment.

Depending on the location, the amount of access to sunlight, and other factors, its possible for homes with solar to sell for 4.1% more than comparable homes without solar energy.

According to a study done by the Department of Energy and Berkeley Laboratory, buyers are willing to pay an extra $12,000 to $15,000 for a home with just an average sized solar array.

For more information on how adding solar can increase rental property value, check out our blog for the scoop.

Also Check: Do I Need A Tax Id Number For Sole Proprietorship

How Do I Use The Tax Credit To Pay Down My Loan

Mosaics solar loan programs are built to be flexible, simple and affordable and, in the case of CHOICE loans, the monthly payments are specifically structured with the federal tax credit in mind. However, whether you opt for a CHOICE or a PLUS loan, you have the option of reducing your monthly loan payments by using your federal tax credit or your own savings. Heres how it works:

CHOICE: Mosaics CHOICE loan product is structured with the federal tax credit in mind, with lower monthly payments you can lock in by applying the full amount of your credit. Heres how it works:

- If you make the voluntary CHOICE prepayment before the end of month 18, it can reduce your monthly payment beginning in month 19

- The earlier the CHOICE payment is applied, the lower future payments will be

- If you pay down your loan by less than the specified CHOICE target loan balance, your monthly payment goes up

Its your CHOICE!

PLUS: Mosaics PLUS loan product which can be used to finance other home improvements, in addition to solar and batteries has monthly payments that do not assume the use of the federal tax credit. However, if you opt to use either the tax credit or personal savings to make voluntary prepayments to reduce your loan principal in the first 18 months, your monthly payments will be reduced for the remainder of the loan term just like CHOICE. However, unlike CHOICE, if you choose to not make any extra pre-payments, your monthly payments will not increase.

Logo

Bottom Line: What To Know About Federal Solar Tax Credits

The federal solar tax credit is a win for any qualifying individual or business installing a solar system on their property. The tax credit helps offset the cost of the system and can make renewable energy far more affordable and attainable to individuals who would like to live a more sustainable lifestyle.

- Article sources

- ConsumerAffairs writers primarily rely on government data, industry experts and original research from other reputable publications to inform their work. To learn more about the content on our site, visit our FAQ page.

Also Check: Arlo Pro 4 Solar Panel

How Does The Solar Tax Credit Work With State Local And Utility Incentives

The federal tax credit isn’t the only incentive available to homeowners who switch to solar. You could be eligible for other incentives offered by your state government, or even your utility company. The type of incentive could potentially impact how much your federal solar tax credit will be worth.

State Utility Or Local Rebates

There are no federal rebates for putting solar on your investment property or making energy-efficient purchases. However, several local and state governments and utility entities offer rebates.

Some solar manufacturers offer special discounts that make solar systems less expensive. Given that rebates and other incentives are available for a limited period, you need to carry out extensive research before purchasing.

Do you have an investment property, for example, rental and commercial premises? Contact us now for a design and an offer specific to your needs and consistent to your financial objectives.

Recommended Reading: How Much Power Does A 5kw Solar System Produce

What If I Owe Less Than My Tax Credit Value

The solar tax credit is non-refundable, meaning if your solar tax credit is worth more than what you owe in taxes, youre not going to get any sort of check or refund for it. But, that doesnt mean you wont get the full value of it. Any leftover value will carry over and be applied to your taxes the next year.

So, lets say you install solar panels and get a $6,000 tax credit, but you only owe $4,000 in federal income taxes. That leaves you with $2,000 of your tax credit that will be applied to next year’s taxes. The tax credit can be carried forward for a maximum of 5 years.

Watch Our Event Recording

Around half of Yarra residents rent the home they live in and most don’t have the benefit of accessing electricity from rooftop solar.

There are now options available to help tenants and landlords share the costs and benefits of solar. Landlords can benefit from increased property value, while tenants save on energy costs.

You May Like: What Is Solid Color Stain

Are You Eligible For The Federal Solar Tax Credit

Anyone who buys and installs a PV system and pays federal taxes is eligible for this solar incentive.

The property in question doesnt even have to be your primary residence. Vacation homes, stationary RVs, and rental properties all qualify if you install solar PV panels on them.

Moreover, there are no maximum limits on the amount of credit you can receive:

- A $20,000 solar installation produces a $5,200 credit.

- A $50,000 solar PV system yields a $13,000 credit.

- A $100,000 solar system translates to a $26,000 credit.

And if the credit exceeds your tax liability for that year, it can be carried forward to the following tax season.

In order to qualify for this solar incentive, you must be the PV system owner. In other words, you have to finance your installation using cash or a low-interest solar loan.

If you finance your PV system using solar leases or a power purchase agreement , the tax credit goes to the third-party lessor of the installation not you.

The same is true with most types of solar incentives, which is why many homeowners prefer to buy their PV systems instead of renting them.

Claiming The Solar Credit For Rental Property You Own

You can’t claim the residential solar credit for installing solar power at rental properties you own. But you can claim it if you also live in the house for part of the year and use it as a rental when you’re away.

- You’ll have to reduce the credit for a vacation home or rental property to reflect the time you’re not there.

- If you live there for three months a year, for instance, you can only claim 25% of the credit. If the system cost $10,000, the 26% credit would be $2,600, and you could claim 25% of that, or $650.

- $10,000 system cost x 0.26 = $2,600 credit amount

- $2,600 credit amount x 0.25 = $650 credit amount

Read Also: Security Camera With Solar Panel