Can You Claim The Solar Tax Credit On An Investment Property That You Own And Rent Out

Yes, you can claim the tax credit on an investment property that you own and rent.

However, it cant technically be claimed under the residential solar tax credit. There are actually two federal solar tax credits: one for homeowners and one for business owners, and in this case, your property would qualify under the business tax credit.

They have slight differences in their step-down schedules and are under different tax code sections, but currently, they are both worth 26% of the cost.

Why Now Is The Best Time To Install Solar Panels

The Residential Clean Energy Credit getting increased to 30% means that now is a great time to go solar. You can take advantage of additional savings, and move toward an electrified future for all of your homes energy needs. This landmark legislation shows our governments commitment to supporting the clean energy economy, and is a clear sign to homeowners that now is the right time to install solar panels.

The solar tax credit has been a major driver of solar industry growth, and for many homeowners, the price difference of a solar power system with and without that tax credit is going to be significant. Thats why theres never been a better time to go solar and take advantage of the maximum amount of the tax credit thats still available while you can.

What Is A Solar Lease

Deciding between buying and leasing is one of the necessary steps before putting solar panels on your roof. Solar leasing works similarly to car leasing. With a solar panel lease, you work with a solar partner and sign a solar lease agreement typically for 20 years.

Thesolar company installs and owns the solar panel system on your roof and benefits from the tax incentives. At the same time, you pay them a set rate monthly to utilize the energy generated from the system. Leasing solar panels allows homeowners to switch to a clean energy source for their homes, reducing their monthly electric bills with no upfront costs.

Read Also: Solar Power Generators For Home

Leasing Solar Panels Cost

On average, leasing solar panels will cost between $50 and $250 per month. This cost is determined by multiple factors, i.e., how much energy you use, the company, your location and your credit score. Plus, some solar companies require a down payment, while others allow you to lease with a $0-down agreement. These costs should be considered when determining if you should lease a solar panel system.

| Leasing Solar Panels | |

|---|---|

| Can pay off or pay back investment | |

| Can save on utility bills | Can save on utility bills |

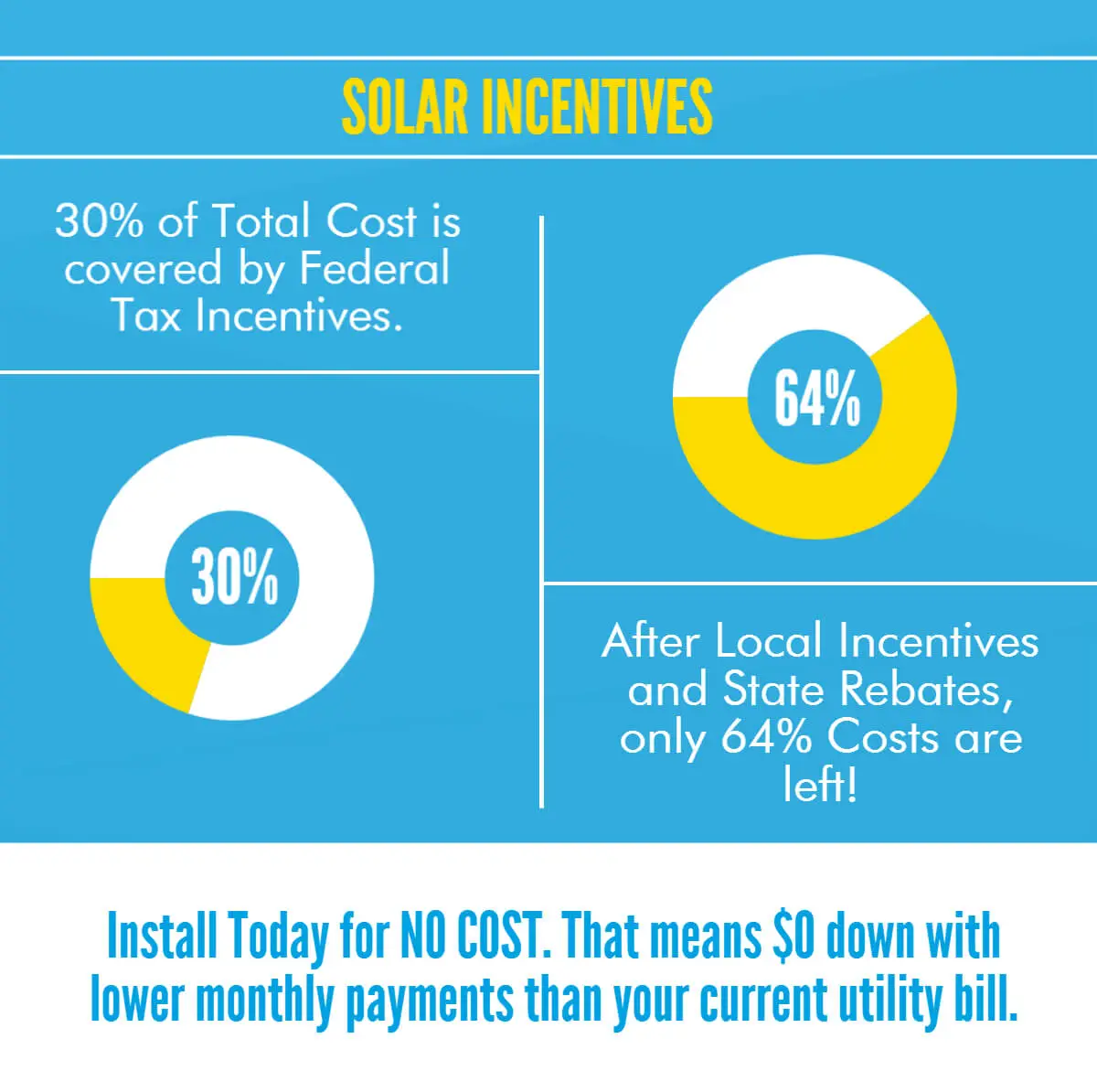

State Incentives And Tax Credits

Unlike utility incentives, state government incentives usually dont need to be deducted before the federal tax credit is calculated.

So, if you installed a $20,000 system and got a $1,000 state government rebate, the solar tax credit would be based on the initial price of $20,000. In this example, that means the tax credit would be worth 30% of $20,000, for a federal tax credit worth $6,000. That would mean you would get a total of $7,000 in incentives.

The same goes for state tax incentives. But, getting a state tax credit will end up increasing your taxable income on your federal tax returns, as you will have fewer state income taxes to deduct. Currently, ten states offer state tax credits, including Arizona, Massachusetts, and New Mexico.

Read Also: Are Solar Panels A Tax Write Off

Take Control Of Your Electric Bills By Going Solar Now

Put the sun to work for you. When you purchase a Sunrun home solar system, the 26% federal solar tax credit is cut directly off the cost of your solar installation. Thats a reduction of thousands of dollars from the total price.

To receive the greatest tax credit benefit, go solar today. Youll lock in long-term lower electricity prices and make the earth a healthier place for everyone. Plus, you dont have to worry about researching incentives and filling out extra tax forms. Weve got you covered.

Additionally, Sunruns home solar service plan is designed for your home characteristics, lifestyle, energy use, and financial goals. Well guide you through the process every step of the way from the tax credit and installation to maintenance and monitoring.

Sunrun is the leading home solar installer in the United States. We’ve been providing renewable energy to homes for more than a decade, and every year the future gets brighter. Together, we’re building an affordable and sustainable energy system for the whole nation, and next generation.

When youre ready to talk about solar for your home, Sunruns team is here for you. Contact us for a complimentary quote. Make a brighter tomorrow by starting today.

See if you qualify for the26% federal tax credit

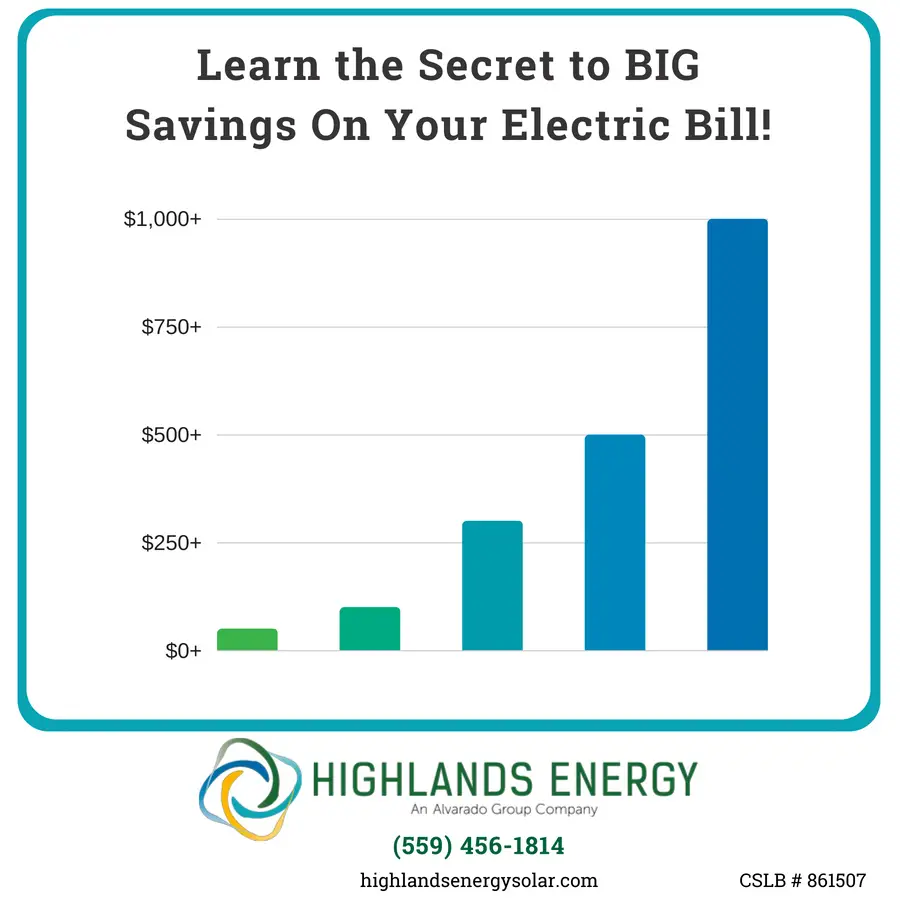

How Much Does The Solar Tax Credit Save You

What does 26% actually mean for the average solar shopper? According to EnergySage marketplace data, the average national gross cost of installing a solar panel system in 2022 is $27,700. At that price, the solar tax credit can reduce your federal tax burden by $7,202, bringing your total cost down to just $20,498 and the ITC is just one of many rebates and incentives that can reduce the cost of solar for homeowners!

Recommended Reading: What Is Sole Custody Mean

Guide To Solar Incentives By State

When it comes to buying solar panels for your home,weve got good news and better news: the cost of solarpower has fallen over 70 percent in the last 10 years,and there are still great solar rebates and incentivesout there to reduce the cost even further.

The first and most important solar incentive to knowabout is the federal solar tax credit, which can earnsolar owners 30% of the cost to install solar panels backon their income taxes in the year after installation.

States and utility companies also offer several types of solarincentives, and whether you qualify to claim them depends onwhere you live and other factors like your tax status.

On this page, you can learn about the different types of solarincentives available to homeowners. You can also choose yourlocation below to discover the exact mix of solar incentivesoffered by your state and utility companies in your area.

What Is The Difference Between Buying And Leasing A Solar Panel System

The main difference between buying and leasing a solar system is who owns the system. When you buy solar panels, whether it be with cash or through a solar loan, you are the owner of the solar panels.

With a solar lease or solar power purchase agreement , you dont have to pay any upfront costs to install solar panels on your roof. Instead, a solar company installs and owns the solar system.

You get to use all of the solar power that your system creates, which cuts down your utility bill with net metering. In exchange for using solar energy, you pay a monthly lease payment to the solar company.

Read Also: How Do Solar Panels Work On A Home

Frequently Asked Questions About The Solar Tax Credit

How does the solar tax credit work 2022?

The federal solar tax credit allows you to deduct 26 percent of the cost of installing a solar energy system from your federal taxes.

What is the federal solar tax credit income limit 2022?

There is no income limit on the ITC program, so taxpayers in all income brackets may be eligible.

When can I claim my solar tax credit?

If youre eligible for the ITC, but you dont owe any taxes during the given calendar year, the IRS will not refund you with a check for claiming the credit. However, according to Section 48 of the Internal Revenue Code, the ITC can be carried back one year and forward 20 years. Therefore, if you had a tax liability last year, but dont have any this year, you can still claim the credit.

What are the steps for claiming solar tax credit in 2022?

There are three main steps youll need to take in order to benefit from the ITC:1. Determine if youre eligible2. Complete IRS Form 56953. Add to Schedule 3 and Form 1040

Who Can Get The Solar Tax Credit

Its available to all taxpayers for their primary or secondary residence located in the U.S. Taxpayers of any income level can take advantage of it. You can use it whether you itemize your taxes or take the standard deduction. Keep in mind, though, that the solar tax credit is available only if you purchase a solar system if you lease one, you cant take advantage of the credit. The same applies if you are a member of a power-purchasing cooperative. However, if you are a tenant-stakeholder in a co-op, you can claim credit for your proportion of the purchase. You can also claim credit for your proportion of the purchase of a community-owned solar system.

Don’t Miss: What Is The Best Angle To Install Solar Panels

Determine Your Tax Liability

Now you need to calculate if you will have enough tax liability to get the full 26% credit in one year. To get started, you first need to have completed sections 1 through 18 on your standard 1040 Form. For the purposes of this example, well assume your tax liability is equal to $5,000.

Now, youll need the instructions for Form 5695. On page 4, youll see a worksheet to calculate the limit on tax credits you can claim. Add the number on line 18 of your 1040 Form to line 1 of this worksheet. If youre claiming tax credits for things like adoption expenses, interest on a mortgage, or buying a plug-in hybrid or electric vehicle, youll need that information in line 2. Youll then subtract the number on line 2 from line 1 to determine your residential energy efficient property credit limit. .

How Does The Solar Tax Credit Work With State Local And Utility Incentives

The federal tax credit isn’t the only incentive available to homeowners who switch to solar. You could be eligible for other incentives offered by your state government, or even your utility company. The type of incentive could potentially impact how much your federal solar tax credit will be worth.

Read Also: Can Solar Panels Damage Your Roof

How The Federal Tax Credit Works

Disclaimer: This blog provides an overview of federal tax incentives for residential solar and alternative energy sources Were solar people, not tax professionals, and this blog does not constitute professional tax advice. It should not be used as the only source of information when making purchasing decisions related to residential energy or for tax filing. Consult a tax professional to determine what makes sense for you.

For many homeowners, going solar is a great opportunity to save on monthly energy bills and reduce your dependence on your utility company. The federal tax credit for going solar can make this investment an even more attractive option.

A tax credit is a reduction in the amount of taxes you owe, according to the IRS. And solar installations often qualify for the residential energy efficient property credit.

As of August 17 2022, the applicable credit percentage are:

For example, a homeowner who finances an 8 kilowatt solar installation for $30,000 could see a tax liability reduction of $9,000 if the credit is 30%. Taking advantage of this credit is easy as A-B-C, if you know the eligibility requirements and how to claim it.

What Expenses Are Eligible For The Itc

While the PTC is calculated based on the electricity produced by a system, the ITC is calculated based on the cost of building the system, so understanding what expenses are eligible to include is important in determining how much of a tax credit the system is eligible for.

To calculate the ITC, you multiply the applicable tax credit percentage by the tax basis, or the amount spent on eligible property. Eligible property includes the following:

- Solar PV panels, inverters, racking, balance-of-system equipment, and sales and use taxes on the equipment

- CSP equipment necessary to generate electricity, heat or cool a structure, or to provide solar process heat

- Installation costs and certain prorated indirect costs

- Step-up transformers, circuit breakers, and surge arrestors

- Energy storage devices that have a capacity rating of 5 kilowatt hours or greater

- For projects 5 MW or less, the tax basis can include the interconnection property costs spent by the project owner to enable distribution and transmission of the electricity produced or stored by the systemthis can include costs that are incurred beyond the point at which the energy property interconnects to the distribution or transmission systems.

Structures and Building-Integrated PV

You May Like: Which Solar Battery Is Best

Solar Leasing Guide: Should You Lease Or Buy

Jump to Section:

Read on for a full explanation of solar leasing. Or, to consult with a professional and start designing your solar panel system right away, you can click the buttons below to get connected with one of the best installers in the nation.

- Most efficient panels on the market

- National coverage

- Cradle to Cradle sustainability certification

- Great warranty coverage

- Customer service varies by local dealer

Services Offered

- Doesn’t offer solar batteries

Services Offered

Solar power is among the most affordable renewable energy options, whether for businesses or homes. Companies that provide solar products are everywhere these days, but to take advantage of the benefits of solar energy, homeowners are faced with a major decision: solar leasing vs. buying panels outright.

A solar lease is a long-term contract between a customer and a solar panel provider. For homeowners seeking to fulfill their energy needs without high utility bills, but who dont have the upfront capital to buy a system, solar leasing can seem like a viable option.

What Is A Tax Credit

Tax credits are a powerful tool that can help you reduce your taxable income and directly impact your annual tax bill. A dollar-for-dollar reduction of the income tax you owe, a tax credit can reduce the amount of tax you owe or increase your tax refund. They also differ from deductions and exemptions.

Read Also: Is Pine Sol Safe On Wood

Overview Of Home Solar Incentives

For those that own solar panels, there are certain installation incentives like tax credits that can lower the cost if you are eligible. With a solar lease, the leasing company can take advantage of the incentives. In other words, you don’t benefit from the tax credits the solar loan company does. You can factor them into your ultimate costs at your own discretion.

The Federal Solar Tax Credit can reduce the upfront costs of solar systems for homeowners planning to buy. A tax credit reduces the amount of taxes you pay when you file.

The federal solar tax credit offers qualified applicants a 30% tax credit for systems installed by December 31, 2032, 26% for systems installed in 2033 and 22% for systems installed in 2034.

There are a few requirements to qualify for the Federal Solar Tax Credit. The solar system must be located at your primary or secondary residence. You must also own the solar system you cannot lease or be in another type of arrangement to get electricity through a solar system you do not own. The system must also be new or being used for the first time. Consult a tax professional to discuss your eligibility.

Tax credit incentives cover more than just the solar panels, according to Energy.gov. Tax credit incentives can also cover your contractor installation costs, costs for inverters, wiring and/or the mounting that the panels sit on. You can also consider energy storage and sales tax as eligible expenses.

Ready To Start Your Commercial Solar Project

As you can see, if youre buying a solar energy system, timing is everything.

We know investing in solar energy is an important financial decision for your business, and our team is here to help guide you through the process.

Fill out the contact form below or call 844.732.7652 during business hours, and one of our solar energy advisors will talk to you about your ITC eligibility.

You May Like: Doordash Dasher Taxes

Don’t Miss: What Is The Average Cost Of A Solar System

Learn More About Solar Tax Credits And How They Can Save You Money On Solar Installation

Florida homeowners are installing solar, reaping the benefits and incentives they bring. Some may consider solar panels cost-prohibitive, but incentives, tax credits, and financing can help to make them more affordable. Investing in solar panels can lower your electricity bills, increase the value of your home, and reduce your dependence on your local utility provider.

Tax credits include the federal solar tax credit or investment tax credit . Since the passage of the Inflation Reduction Act, solar energy will be front and center in the electricity supply. The bill includes over $300 billion in funds for renewable technology and climate measures with an extension of the Solar ITC at 30% for photovoltaic systems and battery storage products that are charged with renewable energy. Install solar energy equipment in your home through 2032, and you will enjoy the nonrefundable credit off of your federal income taxes with no dollar limit.

Who Builds Solar Panels For Tesla

It still only has a manufacturer of 340-watt solar panels, Hanwha Solar.

Does Tesla solar pay for itself?

Tesla solar roof: How much could you save Tesla says the roof will pay off over time. Tiles are estimated to collect energy for 30 years, which means that in practice they can be cheaper than conventional roofs in the long run. That would reduce total costs to $ 4,121, according to Tesla.

Are Tesla solar panels made by Tesla?

No, Tesla is not a manufacturer of its own solar cells. As mentioned above, until recently, Tesla collaborated with the international electronic giant Panasonic to create Teslas solar collectors. The partnership was based on the use of highly regarded Panasonic HIT cells to create Teslas solar panels.

Dont Miss: How Much Is Taxes For Doordash

Read Also: How To Get A Sole Proprietorship In Texas