When Does The Federal Solar Tax Credit Expire

The ITC is not set to expire until 2024, but remember that with time it will eventually go down to 10 percent, and that even in 2023 it will already have gone down to 22 percent.

Right now is the perfect time to take advantage of this program, even if Congress continues their precedent of extending it into the future, because there is no guarantee that the 26 percent rate would be reinstated. Of course, there are always plenty of ways to answer the question of how to pay less taxes, but taking what you can, when you can, is always a good rule of thumb.

In addition to the solar ITC, there may be other local and state tax credits, cash rebates, and net metering opportunities that will not expire in 2024, so even if you havent completed your solar installation by then, it might still be well worth it to perform.

How To Fill Out Irs Form 5695

The Residential Clean Energy Credit is a big incentive for people to adopt any number of energy-efficient systems on their property. Claiming the solar energy tax credit can offset some of the expenses of making energy-efficient improvements to your home.

However, not all taxpayers and improvements qualify for the credits. Your improvements must meet specific energy efficiency requirements, and first-time homebuyers must adhere to particular rules to qualify.

Review the IRS Form 5695 Instructions to confirm your eligibility. You can then complete the form and include it on Form 1040.

Solar Tax Credit: Your Complete Guide To Federal Solar Tax Credit

Have you installed a solar power system or do you plan to have one installed in the next couple of years? In that case, youre probably qualifying for the federal solar tax credit.

To make your solar system installation even more worthwhile, we created this solar tax credit guide will help you understand what is it and how to claim it.

You May Like: How Much Does It Cost To Bird Proof Solar Panels

What Is A Solar Photovoltaics System

A PV system takes sunlight to produce solar electricity using a semiconductor material. Most solar systems have an inverter that converts DC current, which the solar panels produce, to AC electricity, for use by household appliances. Mounting hardware attaches solar panels to the homes roof or the ground.

Solar PV systems sometimes have solar batteries, storing electricity for later use or during blackouts. Solar photovoltaic technology is different from solar thermal technology for water, pool, or space heating, which captures heat instead of generating electricity.

Homes with solar panels have lower electricity bills than homes without. Typically, electricity companies will compensate customers for surplus solar electricity they supply to the power grid, resulting in a much lower electricity bill. Also, homes with solar panel systems tend to have higher resale values partially due to the lower energy bills, a trait that is attractive to home buyers.

Items You Need To Claim Your Federal Solar Tax Credit

To start, you will need your solar installation receipts, along with the IRS 1040 and 5695 forms. Fill out the 1040 paper as usual, but stop at line 53 and move to form 5695. With the 5695 form, enter the cost of installation in line one. Any price related to installation is money you can claim! Reference the step-by-step process on how to file taxes to get a general idea of what to do.

If you want to update panels you installed years ago, you can still receive tax credits. You can claim the tax credit for each new cost related to the addition and wont have to pay it back to the government if you sell the house. Its possible to install solar panels and sell your building at any time yet, this is only true for residential owners, as its a more complicated process for commercial installations.

Also Check: When Can Infants Have Solid Food

How Do I Claim The Solar Tax Credit On My Tax Return

To claim the federal solar tax credit, solar system owners should fill out IRS Form 5695 when filing their federal tax return. If the solar panels were installed in 2022, the homeowner can apply the solar credit with their 2022 federal taxes. In addition, some states offer a state tax credit for going solar so be sure to research state and local incentives as well.

How Its Applied & Who Qualifies

With the federal tax credit , you can deduct 26% of the cost of your solar energy system from your business taxes. This is a dollar-for-dollar credit toward the income taxes that would otherwise go to the federal government. To qualify, the business must have a tax liability upon filing. In other words, if the business owner is going to receive money back from their tax return, then the credit will not be applied for that year and will simply roll forward to the next. The amount deducted is calculated by multiplying 26% by the tax basis, which is the amount invested in eligible property. For solar installations, eligible property can include solar panels, installation costs, racking, circuit breakers, energy storage devices, and sales and use tax on the equipment.

Dont Miss: What Is Pine Sol Good For

Also Check: How To Make A Solar Panel From Scratch

Going Solar Just Got Easier

The new and improved federal solar tax credit has been met with a collective sigh of relief from a solar industry that was racing to squeeze customers in before the previous tax credit stepped down and expired.

Now, the 30% tax credit is here until 2032 and the long term savings of solar in reach for more Americans. In addition, the Inflation Reduction Act made significant investments in American solar manufacturing, which should help to further drive down the costs and increase the benefits of going solar.

With that said, now that the tax credit is at 30%, the best time to go solar is yesterday. The sooner you start producing energy, the sooner youll start saving.

Tax Benefits Of Going Solar

Tapping the sun for power offers several benefits. For example, solar power:

- Doesn’t pollute

- Reduces our use of coal and other fossil fuels

- Reduces your individual carbon footprint

But since the installation of solar power equipment can be costly, the solar tax credit can help you offset some of the costs.

Also Check: How Much Voltage Does A Solar Panel Produce

First Things First: Are You Eligible For The Solar Tax Credit

You are eligible for the Federal ITC as long as you own your solar energy system, rather than lease it. If you sign a lease agreement, the third-party owner gets the solar tax credit associated with the system. This is also true for the vast majority of state and local incentives for solar, although in some special cases a lease will grant you the financial benefits associated with the sale of solar renewable energy certificates . You are also eligible even if the solar energy system is not on your primary residence as long as you own the property and live in it for part of the year, you can claim the solar tax credit.

If your federal tax liability is lower than the total amount of your ITC savings, you can still take advantage of it by carrying over any remaining credits to the following year. In our example, you pay $25,000 to install a solar system on your home in 2022, which means you are eligible for a $7,500 federal solar tax credit. If your federal tax liability for 2022 is only $5,000, you will owe no federal taxes that year, and in 2023, you will reduce your tax liability by $2,500.

| Solar system cost: $25,000 |

|---|

Impact Of The Solar Tax Credit

As the United States races to achieve rigorous clean energy benchmarks, the federal policies and incentives to get us there have heightened. On both a distributed and utility-scale level, solar deployment has grown quickly across the country. The federal tax credit has given businesses, homeowners, and tax payers the opportunity to drive down solar costs while increasing long-term energy stability. The ITC has been a driver of huge success, giving us a stronger and cleaner future: in fact, according to the Solar Energy Industries Association , it has helped the U.S. solar industry expand by over 10,000 percent! Learn more about how solar panel costs and efficiency have changed over time.

Don’t Miss: How Much Is One Solid Gold Bar Worth

How Does The Solar Tax Credit Work In 2021

The federal solar tax credit is the most popular financial incentive for homeowners looking to go solar. The 26% tax credit is a dollar-for-dollar reduction of the income tax you owe. Many homeowners think they are not eligible for the solar tax credit because they dont have an additional tax bill at the end of the year.

This is not the case, the federal solar tax credit can get back a refund of the taxes you have already paid out of your weekly or fortnightly paycheck. Also, if you dont have enough tax liability to claim the credit in that year, you can roll over the rest of your credits to future years.

What Projects Are Eligible For The Itc Or Ptc

To be eligible for the business ITC or PTC, the solar system must be:

- Located in the United States or U.S. territories

- Use new and limited previously used equipment

- Not leased to a tax-exempt entity , though tax exempt entities are eligible to receive the ITC themselves in the form of a direct payment.

Read Also: A Solid Line On The Road Pavement Means

How The Federal Tax Credit Works

Disclaimer: This blog provides an overview of federal tax incentives for residential solar and alternative energy sources Were solar people, not tax professionals, and this blog does not constitute professional tax advice. It should not be used as the only source of information when making purchasing decisions related to residential energy or for tax filing. Consult a tax professional to determine what makes sense for you.

For many homeowners, going solar is a great opportunity to save on monthly energy bills and reduce your dependence on your utility company. The federal tax credit for going solar can make this investment an even more attractive option.

A tax credit is a reduction in the amount of taxes you owe, according to the IRS. And solar installations often qualify for the residential energy efficient property credit.

As of August 17 2022, the applicable credit percentage are:

For example, a homeowner who finances an 8 kilowatt solar installation for $30,000 could see a tax liability reduction of $9,000 if the credit is 30%. Taking advantage of this credit is easy as A-B-C, if you know the eligibility requirements and how to claim it.

What Doesn’t Qualify For The Solar Tax Credit

- Solar installed in an income property in which you don’t maintain your own residence.

- A system that’s leased. In that case, the company that leases it to you gets the credit, though it can pass along all or part of the savings as a discount to you.

- A solar system that’s used to heat a swimming pool or hot tub. The IRS is vague, though, about whether you can prorate your creditthat is, claim a portion of the credit if only a portion of the energy is used to heat your home. Talk to a tax expert for advice.

Recommended Reading: Can You Install Solar Yourself

Whats Covered By The Tax Credit

Homeowners who leverage the 30 percent ITC from the federal government can plan to see the following expenditures covered:

- Cost of solar panels

- Labor costs for installation, including permitting fees, inspection costs, and developer fees

- Any and all additional solar equipment, like inverters, wiring, and mounting hardware

- Energy storage systems rated three kilowatt-hours or greater .

- Sales taxes on eligible expenses

Find Out If You Have Any Limitations To Your Tax Credit

Line 14 For this line, youll need to switch to the worksheet at the top of page 4 in the 5695 instructions.

- Worksheet Line 1 Enter the total taxes you owe .

Example:6,000

- Worksheet Line 2 Enter other tax credits and adjustments youre claiming

Example: 0

- Worksheet Line 3 Subtract Line 2 from Line 1 to find your credit limit

Example: 6,000 0 = 6,000

In this example, your credit limit would be 6,000.

Recommended Reading: How Much Is A Solar Panel For Home

Solar Tax Credit Calculator:

It is easy to give you the rate of the solar tax credit. But it is much harder to give you the dollar value for your specific home. Luckily SolarReviews.com has developed one of the most accurate solar calculators. Using data from local solar installs in your area we can give you a very accurate cost guide for your specific home.

It will show you the dollar value of the federal solar tax credit and include any state tax credits if eligible. This gives homeowners who use our calculator the opportunity to figure out if solar is worth it for their home, before talking to solar companies.

Calculate the dollar value of the tax credit

How To File For The Federal Solar Tax Credit Step

At the time of writing, the 2022 tax forms were not available. The example below is based on forms from tax year 2021 and will likely be different from the 2022 forms. Always consult a licensed tax professional with questions.

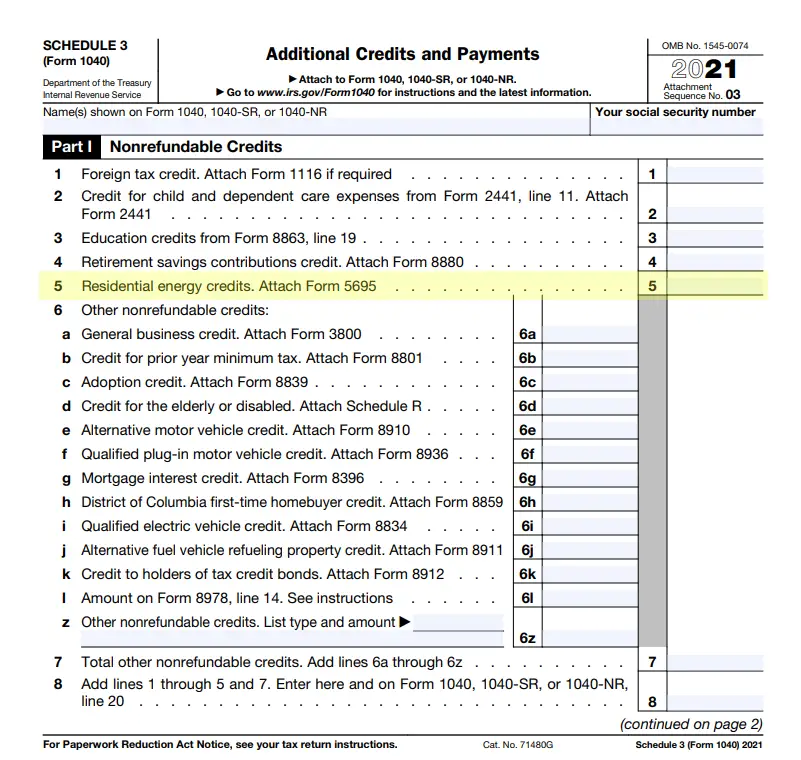

Fill in Form 1040 as you normally would. When you get to line 5 of Schedule 3 , shown below, its time to switch to Form 5695.

Don’t Miss: Solar Panels For Swimming Pools

Am I Eligible To Claim The Solar Investment Tax Credit In 2022

You might be eligible for the solar investment tax credit if you meet all of the following criteria:

- Your solar PV system was placed in service between January 1, 2006, and December 31, 2021.

- The solar PV system is located at a residential location in the U.S. .

- You own the solar PV system

- The solar PV system is new or being used for the first time. The ITC can only be claimed on the originalinstallation of the solar equipment.

Can I Claim The Credit Assuming I Meet All Requirements If:

I am not a homeowner?

Yes.You do not necessarily have to be a homeowner to claim the tax credit. A tenant-stockholder at a cooperative housing corporation and members of condominiums are still eligible for the tax credit if they contribute to the costs of an eligible solar PV system. In this case, the amount you spend contributing to the cost of the solar PV system would be the amount you would use to calculate your tax credit. However, you cannot claim a tax credit if you are a renter and your landlord installs a solar system, since you must be an owner of the system to claim the tax credit.

I installed solar PV on my vacation home in the United States?

Yes. Solar PV systems do not necessarily have to be installed on your primary residence for you to claim the tax credit. However, the residential federal solar tax credit cannot be claimed when you put a solar PV system on a rental unit you own, though it may be eligible for the business ITC under IRC Section 48. See 26 U.S.C. § 25D, which specifies that eligible solar electric property expenditures must be for use at a dwelling unit located in the United States and used as a residence by the taxpayer .

I am not connected to the electric grid?

Yes.A solar PV system does not necessarily have to be connected to the electric grid for you to claim the residential federal solar tax credit, as long as it is generating electricity for use at your residence

The solar PV panels are on my property but not on my roof?

Also Check: How Much Are Solar Panels California

How Is The Federal Solar Tax Credit Calculated

The equation for figuring out how much your solar tax credit is worth is simple.

Gross cost of project x 0.30 = tax credit value

So if your project costs $30,000, your tax credit will be worth $9,000 .

The gross system cost may include improvements needed to facilitate the solar installation, such as electrical box upgrades. However, its best to speak to your tax advisor about your unique circumstances.

The credit is a dollar for dollar income tax reduction. This means that the credit reduces the amount of tax that you owe. It also means that you have to pay and file taxes in the same tax year order to receive the credit.

Now that we know how to calculate your solar tax credit, lets go over how to claim it.

Federal Solar Tax Credit Filing Step

The following is a fictional scenario to be used for example purposes only. Consult a licensed tax professional with questions.

Lets go through the basics of claiming a federal solar tax credit using a fictional $30,000 expenditure on solar only.

Since the 2022 forms havent come out yet, well use the latest IRS forms available. Please understand that these are subject to change.

Step 1: File your taxes as normal

Begin by filing your taxes as you normally would. Tally your income, claim dependents, deduct your charitable donations all that fun stuff.

Your solar tax credit comes into play on Line 5 of Schedule 3 . This form is for claiming additional credits and payments, including residential energy credits.

Heres what the 2021 form looked like. The 2022 form will likely change.

When you hit this point, its time to switch to Form 5695 to calculate your residential energy credit amount.

Step 2: Fill out Form 5695

Weve modified a 2021 Form 5695 below to show an example scenario for a $30,000 solar purchase and the 30% tax credit now available in 2022.

Again, the 2022 forms may look different.

If you only installed solar in 2022, then this form will be relatively simple.

Input the gross cost of your solar installation in Line 1, then multiply it by 0.30 in Line 6b to find your credit amount. In this scenario, its $9,000.

If Line 14 is greater than Line 13, you can use your entire tax credit in one year. Hooray!

Fill in Line 15 with the smaller of Line 13 or Line 14.

Recommended Reading: How Many Solar Panels To Generate 1 Megawatt