Bottom Line: What To Know About Federal Solar Tax Credits

The federal solar tax credit is a win for any qualifying individual or business installing a solar system on their property. The tax credit helps offset the cost of the system and can make renewable energy far more affordable and attainable to individuals who would like to live a more sustainable lifestyle.

- Article sources

- ConsumerAffairs writers primarily rely on government data, industry experts and original research from other reputable publications to inform their work. To learn more about the content on our site, visit our FAQ page.

Money Matters: How To Finance Your Rooftop Solar Energy System

As more Americans explore converting their homes to use solar power, many homeowners are thinking about costs. Todays residential solar installation prices range from $15,000 to $35,000, depending on factors like your roof, where you live, and how much electricity you want your system to produce. The Lawrence Berkeley National Laboratorys Tracking the Sun report contains solar costs across the country.

Most homeowners dont pay the full cost of residential solar, thanks to federal and state incentives. The federal solar investment tax credit is 26% of the total cost of a home solar system installed by December 31, 2022. Many states offer tax credits and incentives that can help bring the cost of owning a solar system within reach. Visit the Database of State Incentives for Renewables & Efficiency to find out whats available in your state. Municipalities and utilities also offer incentives, so ask around to see whats available where you live.

If you dont have the cash to purchase a system upfront, you can obtain a loan or lease a system. Here are your solar financing options:

Note that if you lease or have a PPA, you are not eligible for the tax breaks and incentives available to buyers, but you will save money on energy in the long run and lower your carbon emissions.

Does The Residential Solar Tax Credit Apply To New Home Purchases

If you buy a new home that already has solar installed, you can still claim the Residential Clean Energy Credit in the year that you move in, regardless of when the house was originally built or sold. For example, if your home was built in 2020, and then you bought it in 2021, but didnt move in until 2022, then you would claim the Residential Clean Energy Credit on your 2022 taxes.

Keep in mind, the Residential Clean Energy Credit can only be claimed once, so youll want to check and make sure that your builder hasnt already claimed the credit. If your builder has claimed it, then you may be able to ask for a reasonable allocation for those costs, and factor that into the final purchase price.

Recommended Reading: What Can A 4kw Solar System Power

How Does The Solar Tax Credit Work The Ultimate Guide

If youre debating adding solar panels to your business or home, youve probably heard about the federal solar tax credit.

The federal government is offering a solar tax credit to subsidize the purchase and installation costs of solar panel systems for commercial businesses and residential homeowners throughout the U.S.

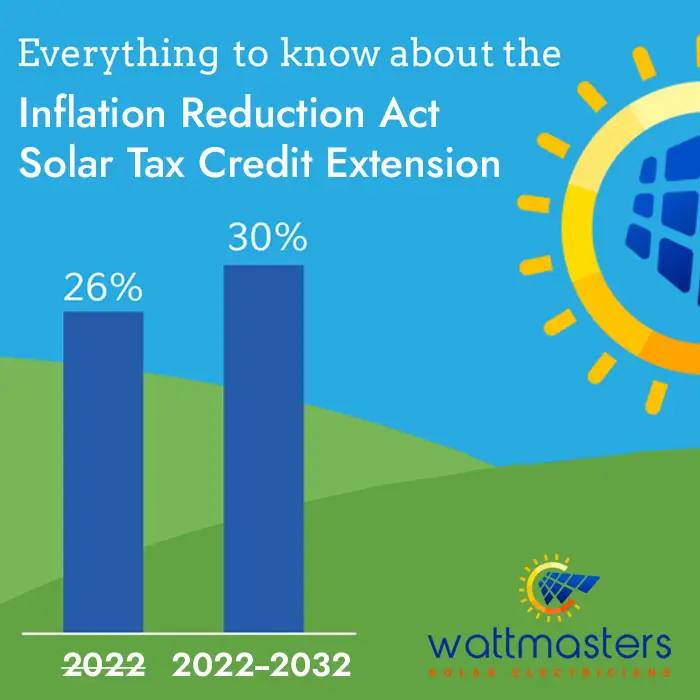

Although the solar tax credit was set to expire in 2023, the Inflation Reduction Act recently extended it as a financial incentive for green energy. That means it continues to be a relevant and helpful option for anyone looking to go solar.

Heres what you need to know about the solar tax credit.

Solar Tax Credit Calculator:

It is easy to give you the rate of the solar tax credit. But it is much harder to give you the dollar value for your specific home. Luckily SolarReviews.com has developed one of the most accurate solar calculators. Using data from local solar installs in your area we can give you a very accurate cost guide for your specific home.

It will show you the dollar value of the federal solar tax credit and include any state tax credits if eligible. This gives homeowners who use our calculator the opportunity to figure out if solar is worth it for their home, before talking to solar companies.

Calculate the dollar value of the tax credit

Recommended Reading: How Does A Solar Battery Charger Work

Additional Tax Benefits For Businesses And Farms

For businesses, the tax benefits extend beyond the 26% Federal Tax Credit. In the recent Tax Cut and Jobs Act, the law changed to allow 100% bonus depreciation for commercial solar systems. This allows the entire cost basis of a solar system to be depreciated in the year it was placed into service.

For example, if you invest $92,000 in a solar system, your business could receive $48,000 or more of that investment back in year one, depending on your tax bracket. Other equipment investments in this same scenario would cost you $192,000 to match the tax benefits that come with a solar investment. That means you will spend nearly 110% more on most comparable equipment investments in order to receive the same tax benefits.

Federal Solar Tax Credit

In this article: How Does the Credit Work | Do I Qualify? | Whats Covered? | How Do I Apply? | | Other Solar Incentives | Resources | | FAQs

Solar energy can save you money on your electric bills and reduce your carbon footprint, but it comes with a high up-front cost. Fortunately, the U.S. government offers a federal solar tax credit, which was recently extended in the Inflation Reduction Act, to help reduce this cost and make the transition to solar more affordable.

This article provides up-to-date information about what the federal solar tax credit is, how to use it, and other tax credits you can take advantage of.

Read Also: Mission Solar Panels For Sale

Take Control Of Your Electric Bills By Going Solar Now

Put the sun to work for you. When you purchase a Sunrun home solar system, the 26% federal solar tax credit is cut directly off the cost of your solar installation. Thats a reduction of thousands of dollars from the total price.

To receive the greatest tax credit benefit, go solar today. Youll lock in long-term lower electricity prices and make the earth a healthier place for everyone. Plus, you dont have to worry about researching incentives and filling out extra tax forms. Weve got you covered.

Additionally, Sunruns home solar service plan is designed for your home characteristics, lifestyle, energy use, and financial goals. Well guide you through the process every step of the way from the tax credit and installation to maintenance and monitoring.

Sunrun is the leading home solar installer in the United States. We’ve been providing renewable energy to homes for more than a decade, and every year the future gets brighter. Together, we’re building an affordable and sustainable energy system for the whole nation, and next generation.

When youre ready to talk about solar for your home, Sunruns team is here for you. Contact us for a complimentary quote. Make a brighter tomorrow by starting today.

See if you qualify for the26% federal tax credit

Am I Eligible For The Federal Solar Tax Credit

According to the Office of Energy Efficiency & Renewable Energy , the following criteria determines your eligibility to claim the federal solar tax credit:

- Date of installation: Your solar PV system is installed between .

- Original installation: The solar PV system is new or being used for the first time. The credit can be claimed only on the original installation of solar equipment.

- Location: The solar PV system is located at your primary residence or secondary home in the United States. It can also be for an off-site community solar project if the electricity generated is credited against your homes electricity consumption and does not exceed it.

- Ownership: You own the solar PV system. You are not leasing or in an agreement to purchase electricity generated by the system, such as a solar power purchase agreement .

Get a Quote on Your Solar Installation

Recommended Reading: Labor Cost To Install Solar Panels

How Do I Claim The Solar Tax Credit

If you purchase a solar energy system and it belongs to your business or household, youre eligible for the solar tax credit. You can claim the credit when filing your annual federal tax return.

Make sure to let your accountant know youve installed solar panels in the past year. If you file your own taxes, simply use tax form 5695.

Gains From Renewable Energy Certificates

Solar renewable energy certificates are given to solar system owners who have exported one MWh of electricity into the grid. The REC is a commodity that can be sold in the open market. These act as carbon credits and entities with carbon deficits buy them to offset their emissions.

When you sell your RECs, the amount received will be treated as your income in the computation of income tax. However, this will not have any effect on the federal tax credit.

Read Also: What Would A 100 Watt Solar Panel Power

What If I Dont Owe Taxes

You may be asking yourself, How does the solar tax credit work if I dont owe taxes? Anyone who does not owe federal income taxes will not be able to benefit from the solar tax credit in the current year. And, if youre on a fixed income, retired, or only worked part of the year, you may not owe enough taxes to take full advantage of this solar tax credit.

While many solar panel systems qualify for the solar panel tax credit, there are some that do not. Consult a qualified tax professional to understand any tax liability or eligibility for any tax credits that may result from the purchase of your solar system.

New York State Real Property Tax Exemption

- Form RP 487 from New York State Department of Taxation and Finance

- File this form with your local property assessor. Some municipalities and school districts have opted out and will include the value of the solar installation in your property tax assessment without the exemption. You can call your local assessors office to find out whether your community has opted out, or reference the online list of municipalities that have opted out.

Read Also: How To Place Solar Panels

Impact Of The Solar Tax Credit

As the United States races to achieve rigorous clean energy benchmarks, the federal policies and incentives to get us there have heightened. On both a distributed and utility-scale level, solar deployment has grown quickly across the country. The federal tax credit has given businesses, homeowners, and tax payers the opportunity to drive down solar costs while increasing long-term energy stability. The ITC has been a driver of huge success, giving us a stronger and cleaner future: in fact, according to the Solar Energy Industries Association , it has helped the U.S. solar industry expand by over 10,000 percent! Learn more about how solar panel costs and efficiency have changed over time.

How Solar Tax Credits Work

The tax credit is a reduction in an individuals or business’s tax liability based on the cost of the solar property. Its a nonrefundable tax credit, meaning you wont get more back than the amount you owe in taxes.

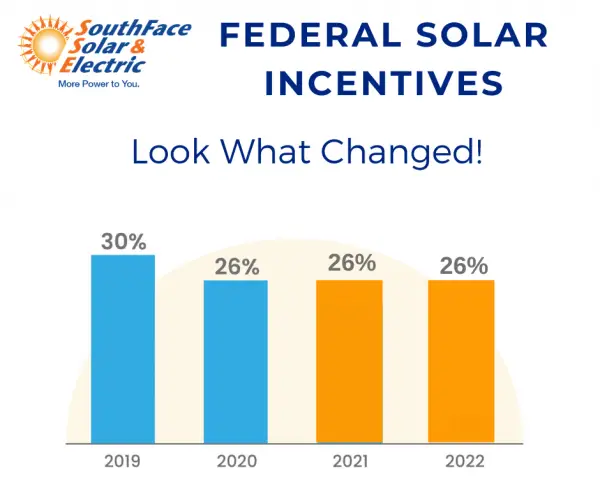

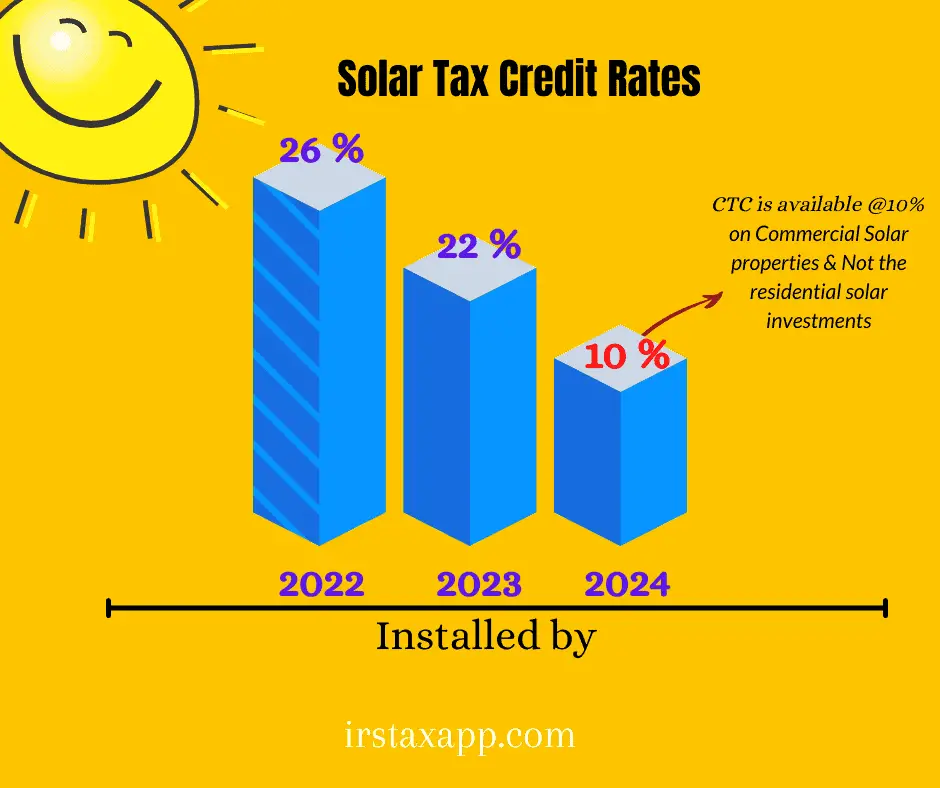

Projects that begin construction in 2021 and 2022 are eligible for the 26% federal tax credit, while projects that begin construction in 2023 are eligible for a 22% tax credit. Residential tax credits drop to 0% after 2023, but commercial projects will drop to 10%.

As of 2021, the solar ITC is a 26% federal tax credit.

Homeowners who purchase a newly built home with a solar system are eligible for the ITC the year they move into the house if they own the solar system. Those who lease a solar system or who purchase electricity through a power purchase agreement are not eligible for the ITC the company that leases the system or offers the PPA collects the credit.

Anyone wishing to claim the credit should first consult with a tax professional to ensure that they are eligible. It’s smart to speak with an advisor before making a major investment that you intend to claim on your taxes.

Kelly McCann, an attorney at a law firm that specializes in real estate and construction law in Portland, Oregon, said these tax credits can be a huge bonus for taxpayers when they understand how they work.

McCann offered the following example:

Suffice it to say, tax credits are better for the taxpayer than are tax deductions, McCann said.

Don’t Miss: How Is Solar Energy Better For The Environment

Everything You Need To Know About The Solar Tax Credit

The Solar Tax Credit, officially called the Residential Clean Energy Credit, is a tax credit that allows you to deduct up to 30% of the cost of your solar energy system from your federal taxes. By helping to offset the cost of purchasing residential solar, the tax credit is designed to get more homeowners to install solar, stimulate investment in the solar industry, and accelerate the pace of solar investment and innovation.

In this article, we will explain what the Residential Clean Energy Credit is, how the federal solar tax credit works, the value of tax credits for home solar, the history of solar tax credits, how to claim the solar tax credit on your tax returns, and then answer FAQs that you might have.

What Expenses Are Included

The following expenses are included:

- Solar PV panels or PV cells

- Contractor labor costs for onsite preparation, assembly, or original installation, including permitting fees, inspection costs, and developer fees

- Balance-of-system equipment, including wiring, inverters, and mounting equipment

- Energy storage devices that have a capacity rating of 3 kilowatt-hours or greater . If the storage is installed in a subsequent tax year to when the solar energy system is installed it is still eligible, however, the energy storage devices are still subject to theinstallation date requirements). Note: A private letter ruling may not be relied on as precedent by other taxpayers.

- Sales taxes on eligible expenses

Read Also: How To Become A Solar Dealer

Not All Car Brands Will Qualify

Certain EV brands that were eligible for a separate tax credit that began in 2010 and that will end this year may not be eligible for the new credit. Several EV models made by Kia, Hyundai and Audi, for example, won’t qualify at all because they are manufactured outside North America.

The new tax credit, which lasts until 2032, is intended to make zero-emission vehicles affordable to more people. Here is a closer look at it:

How To Qualify For The Solar Tax Credit

In order to qualify for the solar panel tax credit, you must own your home and you must pay enough taxes to the federal government that the Residential Clean Energy Credit can offset your tax payment.

For example, if you paid $10,000 to install solar on your principal residence in 2022, then the 30% Residential Clean Energy Credit would mean you are eligible for a tax credit of $3,000. In order to claim that credit, you need to have owed at least $3,000 in federal taxes before the solar tax credit. If you owed more than $3,000 then the Residential Clean Energy Credit would reduce the total amount that you owe. If you owed less than $3,000 then the Residential Clean Energy Credit would eliminate your tax liability for that year.

In addition, if you do owe less than your total Residential Clean Energy Credit savings for the year that you install your solar system, you can actually roll over any remaining credits to the following year, so that you dont lose the value of those credits.

For example, if you were eligible for $6,500 in tax credit, but only owed $4,000 that year, then you would completely eliminate your tax payment for that year, and the next year you would be able to deduct an additional $2,500 from that years tax payment as well.

Don’t Miss: What Is The Return On Investment For Solar Panels

How Does The Tax Credit Work

You can claim the federal solar tax credit as long as you are a U.S. homeowner and own your solar panel system. You can claim the credit once it will roll over to the next year if the taxes you owe are less than the credit you earn. Keep in mind that the credit is a deduction, not a refund.

For example, if you install a solar panel system for $19,000, youll owe $5,700 less on your federal tax return. If your tax liability is less than $5,700, the remainder of the credit will roll over and be applied to your federal income taxes the following year.

How To Get Started With Solar And Claim Your Residential Clean Energy Credit

If youve ever considered going solar, and thought about how to get your solar tax credit, then theres never been a better time to get started! The Residential Clean Energy Credit allows you to get money back on your solar energy system, and going solar now will ensure you get the biggest return on your investment while the solar tax credit is still available.

Over the years, solar tax credits have played an important role in influencing federal policy incentives for clean energy in the United States. The long-term stability of the Residential Clean Energy Credit will allow businesses to continue driving down costs and investing in their own growth, and by investing in solar, you will be helping create jobs and strengthen the economy, while saving yourself money in the process.

Get started today with a free design and savings estimate from Palmetto, to learn more about how the solar power federal tax credit can help reduce your out-of-pocket expenses. Solar panels are a great way to offset your energy costs and reduce the environmental impact of your home, while giving you energy independence and control over your familys future. Now is the time to install solar and take advantage of the Residential Clean Energy Credit!

Recommended Reading: How To Make Replacement Stakes For Solar Lights