Summary Of Arizona Solar Incentives 2022

Arizona is one of the sunniest states in the country. Just because of this fact alone, you can save a lot of money here with solar. But, your solar savings can be even higher when you take advantage of the rebates and incentives the state has in place.

A lot of the incentives that used to be available to Arizonians have since expired. But, there are still enough incentive programs left that can potentially save you thousands of dollars on a solar installation – and thousands of dollars on your electricity bills.

In addition to reading on to see what incentives you qualify for, use our calculator above to see how much you can save with solar.

Ways To Work With Arizonas Net Billing Law

In Arizona, its best to size your system to match your needs . You might also consider installing solar battery storage. That way, you can use the power produced by your solar panels as needed during the day and store any excess for later use, such as overnight or on less sunny days. Youll draw less from the grid and youll export less to the grid, making for greater cost savings overall.

Solar batteries are expensive, though, so may not be worth the cost if you dont stand to save much on your electricity bill. If, however, you produce a lot of electricity during the day and use a lot at night, a solar battery may pay for itself in cost savings and help you future-proof against rising costs of electricity.

Exemption From Real Estate Tax For Energy Systems

Installing a solar energy system includes worth to your house, however Arizona uses a Exemption from real estate tax so that you do not need to pay taxes on this included worth. photovoltaic panel systems arent the only solar and performance enhancements covered by this exemption. Here is a list of the other consisted of gadgets:

- Passive solar innovation, such as B. a Trombe wall

- Solar swimming pool heating units

- Solar area heating units

- Solar thermal electrical

- Solar hot water heater

Depending on where you live, extra gadgets might fall under this exemption. Check with your regional tax authority to guarantee youre optimizing your cost savings.

Recommended Reading: How To Become A Solar Panel Technician

How Much Can You Save With The Solar Tax Credit In 2021

For example, if your solar installation costs were $20,000, you can take 26% of those total costs and subtract them from what you owe in federal taxes on your tax return. Thats a savings of $5,200 from taxes you would normally be required to pay!

If the ITC had not been extended, the tax credit savings would have added up to $4,400 at the previously scheduled 22% rate thats $800 less. So, the tax credit extension just gave homeowners looking to reduce their carbon footprint and take their energy into their own hands hundreds of dollars in tax savings!

Bonus ITC Savings: If the amount you are allowed to reduce from your taxes is greater than what you owe, you can rollover the remainder into the next tax year, so that all of the tax savings can be utilized for their intended purpose.

What Should Arizonans Know About The Federal Solar Investment Tax Credit

Regardless of where your solar panels are installed in the U.S., you can claim a 30% federal solar tax credit for the total cost of your solar energy device on your next declaration. In the case of Arizona, this benefit is combined with a residential state tax credit and two tax exemptions.

- The 30% tax credit will remain available until the end of 2032, decreasing to 26% in 2033 and 22% in 2034.

- The tax credit will be phased out in 2035 unless it is renewed by Congress.

Solar batteries and solar water heaters can also qualify for the 30% federal tax credit. However, for solar batteries, they can only be charged with your solar panels, and not with electricity from the grid.

Recommended Reading: Do You Get A Tax Credit For Installing Solar Panels

Which Solar System Is Right For Your Home

If youve weighed all the available renewable energy options, including wind and electric, and decided on solar, then you already know that youll have to get specific about the kind of system that would be ideal for your homes physical space and for your familys energy needs. Here are important factors to consider:

- Weather during time of the installation

- Positioning system to maximize sunlight

- The age and condition of your roof

- Local Regulations by authorities

- Guidelines and prohibitions of the homeowners insurance company and neighborhood homeowners association

- Using a licensed contractor and qualified devices

- Energy consumption of your family

- Finances: Decide to rent or own the system

What Solar Incentives Does Arizona Offer

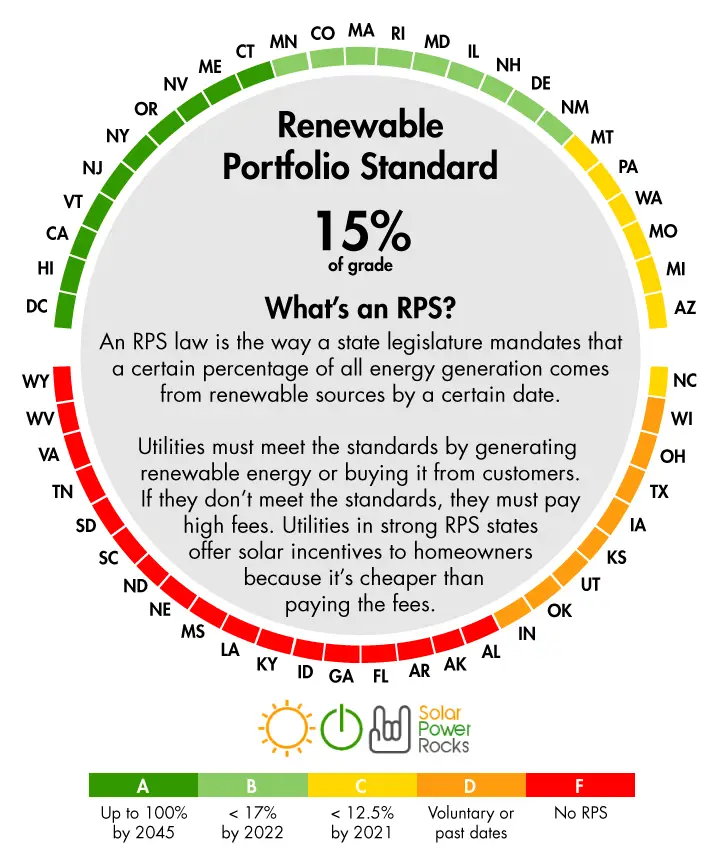

The abundance of sunshine in Arizona is a natural incentive for solar power systems, since you get more kilowatt-hours of energy from each photovoltaic panel you install. However, the state also offers several tax benefits when going solar, which can add up to significantly reduce your solar payback period. Here is a summary of each incentive:

| Arizona Solar Incentive |

Also Check: Solar Lights For Round Fence Posts

On This Page You Can:

Learn what solar incentives are available to Arizona homeowners

See what Arizona solar incentives you qualify for based on your utility company and city

Find out how much these incentives and/or Arizona solar tax credits will reduce your cost to go solar and add batteries

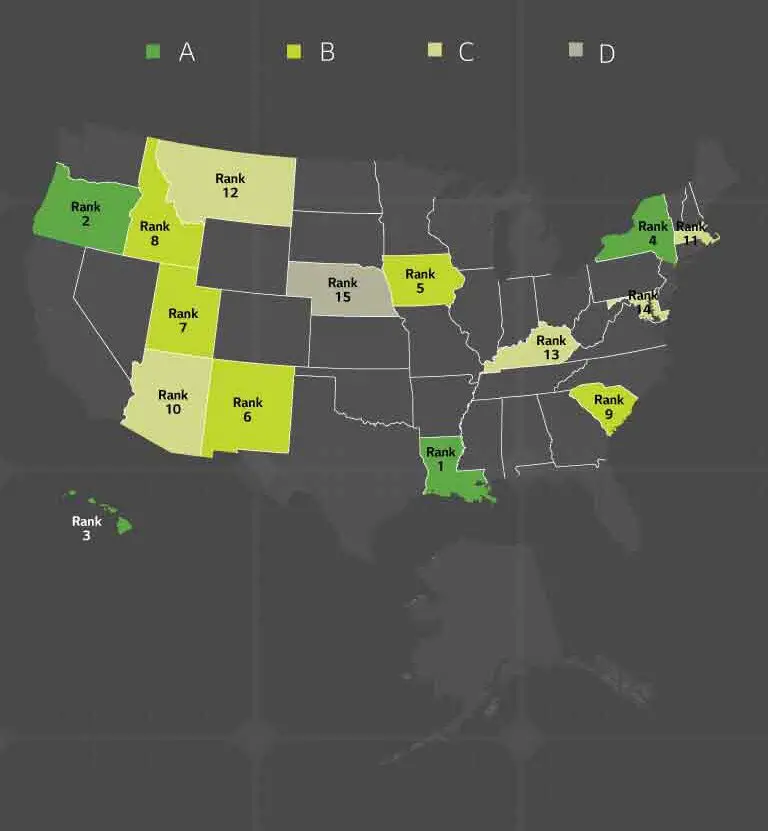

What Should You Know About Arizonas Solar Market

The Grand Canyon State is one of the sunniest states in the country thanks to its desert climate, which means that solar panels are very productive when used on homes and businesses. There are also several incentive programs that improve your return on investment, including the Arizona solar tax credit.

According to the Solar Energy Industries Association , Arizona installed more than 6,100 megawatts of accumulated solar capacity. This is enough to provide electricity for over 907,000 homes and make Arizona the fifth-largest solar market leader in the U.S.1

So, what kind of financial incentives can homeowners in Arizona take advantage of when going solar? Lets dig in.

Watch Below: See How the State of Arizona Is Preparing Its Energy Infrastructure For An Expected Increase In Population

Don’t Miss: How Many Solar Panels To Power A Refrigerator

Other Frequently Asked Questions

If the tax credit exceeds my tax liability, will I get a refund?

This is a nonrefundable tax credit, which means you will not get a tax refund for the amount of the tax credit that exceeds your tax liability. Homeowners may get a tax refund at the end of the year due to the tax credit, if the reduction in tax liability means there was overpayment during the year. This can often occur when employers deduct taxes for employees over the course of the year. However, such refund is still limited by the taxpayers total tax liability. However, you can carry over any unused amount of tax credit to the next tax year.

Is the cost of a roof replacement eligible for a tax credit?

Sometimes. Traditional roof materials and structural components that serve only a roofing or structural function do not qualify for the credit. However, some solar roofing tiles and solar roofing shingles serve both the functions of solar electric generation and structural support and such items may qualify for the credit.

Can I use the tax credit against the alternative minimum tax?

Yes. The tax credit can be used against either the federal income tax or the alternative minimum tax.

I bought a new house that was constructed in 2022 but I did not move in until 2023.

May I claim a tax credit if it came with solar PV already installed?

Federal Solar Tax Credit*

In addition to Arizonas solar incentives, youll be eligible for the federal solar tax credit if you buy your own home solar system outright. The federal solar tax credit gives you a dollar-for-dollar reduction against your federal income tax. The 30% tax credit applies as long as the home solar system is installed by December 31, 2019. Starting in 2020, the value of the tax credit will step down to 26%, and then again to 22% in 2021. After 2021, the tax credit for residential solar ends. Learn more about federal solar incentives.

The information on our website is general in nature and is not intended as a substitute for competent legal, financial or electrical engineering advice. Reviews on this site do not reflect the views or opinions of AZ Solar or its directors or shareholders, nor an endorsement of any third party company. We make no representation as to the accuracy of the information entered by third parties. We disclaim any liability for any damages or loss arising from your use thereof.

Also Check: How To Register A Sole Proprietorship Business In Ontario

How Much Can You Save On Solar In Arizona

Arizona homeowners can save thousands of dollars on solar in Arizona. Residents can save thousands on their solar energy systems using the federal tax credit and the Arizona tax credit.

On top of these two credits, some Arizona homeowners might have access to additional price cuts through their utility companies. Some utility companies offer direct rebates, while others provide payback programs for overproduced energy. These policies and programs vary based on the utility company, so the additional incentive may not be available to everybody.

Aside from the installation cost savings, homeowners can save thousands or even tens of thousands after installation. With an adequately sized system, homeowners might generate enough power to completely eliminate their electric bill, saving them thousands they would have otherwise paid to the utility company.

Final Thoughts On State Solar Incentives In Arizona

Arizona isnt the most generous state when it comes to rebates and incentives for solar, but it remains a great place to go solar anyway. With a state exemption for sales and property taxes, and a generous 25% tax credit, homeowners can reduce their solar payback period right off the bat.

The biggest incentive for solar in Arizona is the sunshine, though, and the federal tax credit. Make sure to go solar before the end of 2022 though, or youll miss out.

Leigh Matthews, BA Hons, H.Dip. NT

Don’t Miss: Can You Use Pine Sol In Laundry

Tax Credits Up To 2021

The Solar Investment Tax Credit isnt permanent. Originally, the legislation was proposed to go on only until 2007 but with the help of solar advocates, Congress has extended the policy. Homeowners and businesses can now enjoy solar tax credits until 2021.

This helps solar companies plan out innovation and investments, and help solar prices go down in the following years. Some solar installers, like Pep Solar, even let you get started on solar energy at little to no cost. If youre thinking about investing in solar, now would be the best time.

Claiming Your Solar Tax Credits

One of the advantages of owning your own solar panel system as opposed to leasing is youre eligible for tax credits. After you have determined that you qualify for the Federal ITC, here are the steps to to claim the tax credit:

- Step 1: Complete the IRS Form 5695 to validate your qualification

- Step 2: Fill up your Individual Income Tax Return form 1040 and indicate your renewable energy credit information

Be sure to contact your tax adviser for more information on income tax returns.

You May Like: Can I Rent My House With Solar Panels

What Are Solar Incentives

Renewable energy sources are more important than ever so the Federal and local Governments are promoting these cleaner sources of energy by reducing investment costs. These cost reductions go by the name of Solar Incentives and these allow Americans to affordably install photovoltaic panels on their homes.

Net Metering In Arizona

Arizona law no longer requires full retail net metering . Some rooftop solar customers may be able to access full net metering depending on where they live and their available utility. In addition, rooftop solar customers who signed contracts prior to the 2016 ruling are eligible to keep their net metering rates for a set time period.

Going forward, utilities may offer net billing instead. Under this system, homeowners get credit for excess energy at an excess generation credit rate. This is lower than the retail rate of electricity. Typically, the utility will buy back exported energy from your solar system at a rate 5-30% lower than the price you pay to buy electricity.

Importantly, Arizona uses instantaneous netting for its net billing programs. This means that the utility tallies up the energy you draw from and feed into the grid in a short time period, often 15 minutes or an hour, then charges or compensates you at the retail rate or excess generation credit rate respectively.

Read Also: Different Types Of Solar Energy

Solar Incentives For Nonprofits And Businesses In Arizona

As of 2022, there arent any solar incentives specific to nonprofits or businesses in Arizona. That said, several government and commercial savings plans exist to aid nonprofits with affording solar energy systems. In addition, businesses and nonprofits alike can benefit from the ITC, and some may even qualify for the USDA REAP grant.

Do Solar Panels Increase Property Taxes In Arizona

No, installing solar panels on your Arizona home will not increase property taxes. Although many home improvements raise the value of your home and, therefore, your property taxes, Arizona solar energy systems will not increase your property taxes.

However, adding a solar energy system increases your homes value, so its a win-win.

Recommended Reading: How To Use Pine Sol On Wood Floors

Where To Find Solar Incentives

The N.C. Clean Energy Technology Center, funded by the U.S. Department of Energy, at N.C. State University has created one of the most comprehensive systems in the country to search and learn about information on incentives and policies that support renewables and energy efficiency. This system is called DSIRE© and it allows information to be easily filtered by state. Information on this site is constantly updated, making it straightforward to those applying for incentives, as the current requirements are clearly listed.Solar systems are a great addition for Arizona homeowners to consider as the benefits more than likely outweigh the costs. Solar power reduces cost, encourages and supports green-living in your community and enhances your overall lifestyle. Be sure to speak with a residential solar system expert to learn more about the solar incentives available to you.

How Much Will My Electricity Bill Go Down With Solar In Arizona

Like its sunny neighbor New Mexico, Arizona receives about 300 days of sunshine annually. Although sunshine percentages vary throughout the state, most of Arizona receives much more sunny days than the national average.

In some cases, homeowners can completely eliminate their electric bills. Of course, this depends on the size of the system and the specific location. For example, an undersized system will only account for a portion of your energy consumption, so you will need some power from the grid.

Don’t Miss: How To Dispose Of Old Solar Panels

Arizonas Energy Systems Tax Credit

An income tax credit is also available at the state level for homeowners in Arizona. Known as the Residential Solar and Wind Energy Systems Tax Credit, this incentive gives you a tax credit of 25 percent for your new solar energy system. The reimbursement is capped at a maximum of $1,000 credit per residence, irrespective of the number of energy devices installed in your home. You can also carry forward any excess credit you have for up to five years making it even more convenient for homeowners to keep saving on a solar installation. To be eligible for this tax credit, your energy system must be compliant with the applicable standards of safety and performance, and have the required warranties on its parts.

Arizona Solar Tax Credit & Incentive Guide For 2022

Theres never been a better time to go solar in Arizonaand were not just saying that because were a solar company. Not only does Arizona have more sun exposure than any other state, but it also ranks second for the most residential solar installations in the United States.

Moreover, the Grand Canyon State is one of only a handful of states that offer a state tax credit on top of the federal solar tax credit. Those are just two of the several solar incentives and rebates available to Arizona residents that can help offset the cost of a solar panel system.

Read Also: How To Open Solar Panel Business

What Is A Tax Credit

A tax credit is a dollar-for-dollar reduction in the amount of income tax you would otherwise owe. For example, claiming a $1,000 federal tax credit reduces your federal income taxes due by $1,000. The federal tax credit is sometimes referred to as an Investment Tax Credit, or ITC, though is different from the ITC offered to businesses that own solar systems.

Get Your Solar Energy System Today

Besides these Arizona solar incentives, there are many reasons to get this type of energy system for your home or business. It reduces your energy bill and it helps the environment too.

The state of Arizona gives you even more reasons to switch to solar. Sunny Energy has the tools for you to make it happen. Were based right here in Arizona and our experts are always standing by to help you with your solar energy project.

Come check us out and see how we can help you save money on your energy bill today!

Don’t Miss: How Does Solar Heating Work